You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Jonathan Anderson - Designer, Creative Director of JW Anderson & Christian Dior

- Thread starter Creative

- Start date

susseinmcswanny

Well-Known Member

- Joined

- May 7, 2020

- Messages

- 2,887

- Reaction score

- 8,002

People are always talkingWho's next? Tokyo Toni?

PDFSD

Well-Known Member

- Joined

- Mar 27, 2024

- Messages

- 2,965

- Reaction score

- 10,537

TurkicMongol

Well-Known Member

- Joined

- Jul 18, 2025

- Messages

- 140

- Reaction score

- 529

I wonder how much those celebrities help drive the sales especially when most of them cannot even sell their own movies/records.

BTW, why did she put the hand in her *** in public? I am too conservative to grasp it.

BTW, why did she put the hand in her *** in public? I am too conservative to grasp it.

PDFSD

Well-Known Member

- Joined

- Mar 27, 2024

- Messages

- 2,965

- Reaction score

- 10,537

attention drives sales yes free high value press impressions that can go further than a brand advI wonder how much those celebrities help drive the sales especially when most of them cannot even sell their own movies/records.

BTW, why did she put the hand in her *** in public? I am too conservative to grasp it.

hamburgers

Well-Known Member

- Joined

- Mar 25, 2025

- Messages

- 269

- Reaction score

- 1,161

It's a bit too obvious and boring that they are trying to reverse engineer Miu Miu's formula for popularity to their prep as post-streetwear agenda.

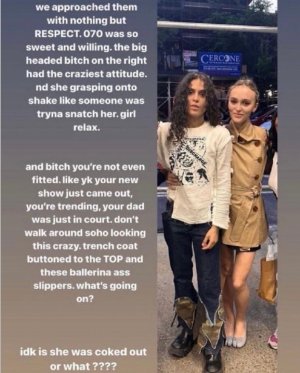

I was thinking awhile ago that Lily Rose Depp and 070 Shake are kind of the embodiment of current Miu Miu with the former's coquettish style and the latter's butch style. The "menswear" relaunch at Miu Miu after all is masculine-leaning gender neutral clothes with female enclosures (right over left) as opposed to men's enclosures (left over right) for all the Julia Nobis's, Loli Bahia's, Selena Forrest's etc. of the world.

I was thinking awhile ago that Lily Rose Depp and 070 Shake are kind of the embodiment of current Miu Miu with the former's coquettish style and the latter's butch style. The "menswear" relaunch at Miu Miu after all is masculine-leaning gender neutral clothes with female enclosures (right over left) as opposed to men's enclosures (left over right) for all the Julia Nobis's, Loli Bahia's, Selena Forrest's etc. of the world.

PDFSD

Well-Known Member

- Joined

- Mar 27, 2024

- Messages

- 2,965

- Reaction score

- 10,537

Honestly i would have liked her for Chanel as Coco flirted with lesbian codesand community in her time with the one hand in pocket code on pictures and Tom boy attitudes etc but they have too many male rapper i guess lolIt's a bit too obvious and boring that they are trying to reverse engineer Miu Miu's formula for popularity to their prep as post-streetwear agenda.

I was thinking awhile ago that Lily Rose Depp and 070 Shake are kind of the embodiment of current Miu Miu with the former's coquettish style and the latter's butch style. The "menswear" relaunch at Miu Miu after all is masculine-leaning gender neutral clothes with female enclosures (right over left) as opposed to men's enclosures (left over right) for all the Julia Nobis's, Loli Bahia's, Selena Forrest's etc. of the world.

Snejana Onopka

Well-Known Member

- Joined

- Apr 29, 2020

- Messages

- 202

- Reaction score

- 1,004

style_expert

Well-Known Member

- Joined

- Jan 6, 2006

- Messages

- 8,944

- Reaction score

- 1,763

So this 070 Shake will attend the next Dior show with her father-in-law but without her girlfriend I guess? It's all so...tangled.

The thing I remember most from JWA's womenswear debut was the awkward interaction between Johnny Depp and Brigitte Macron...

The thing I remember most from JWA's womenswear debut was the awkward interaction between Johnny Depp and Brigitte Macron...

Maybe someone should remind her it's actually her job to promote DIOR and not herself as Frederic already pointed out..Dior really needs fresh, young energy in the PR department with new ideas and not the same auto-pilot mode it has been on for long. I don't know if Peter Utz can bring it...hopefully!I saw pics of Mathilde Favier in the new Dior and she looked chic.

When you dress for yourself, it always makes a difference…

Lola701

Well-Known Member

- Joined

- Oct 27, 2014

- Messages

- 13,993

- Reaction score

- 37,649

Ah non Lola, she is totally cringe and gives massive narcissist energy. Just take a look at her book for goodness sake! Talk about self obsessed! For me this kind of energy is the opposite of chic. If someone is that self-promoting on social media, for me it puts me right off.

They need some new perspectives at Dior, not these dinosaurs all the time with the same strategy and vision all the time. All this talk of a “fashion reset” but no real change beyond the design team, what’s the point? If we are really in the era of modernity and newness then all of these boomers need to go and we need fresh new voices and perspectives.

Maybe someone should remind her it's actually her job to promote DIOR and not herself as Frederic already pointed out..Dior really needs fresh, young energy in the PR department with new ideas and not the same auto-pilot mode it has been on for long. I don't know if Peter Utz can bring it...hopefully!

I won’t say anything bad about Mathilde personally…

She is quite a pleasant woman, much more pleasant than the image I had of her when she was at Prada.

I totally understand that longstanding tradition in fashion of having women from her background in this kind of positions…

However, I agree that something has to be done, changed in the staff of those brands, particularly at Dior where those new ambassadors seems a bit odd. It’s quite hard to understand their strategy indeed.

At Chanel, they have a rather coherent line up of out there people. Whatever we may think of ASAP Rocky, he can dress. I’m not a fan of Kristen but she is still an A-list actress. The blackpink girl is actually a star. Whitney Peak is probably the only odd name at Chanel but I guess much like Anna Mouglalis, her work will be to be an Ambassador.

I’m not sure that Peter is the person because after all, Bialobos is still the head of everything.

But I agree that a shift in aesthetic should be reflected up through the PR department.

Even more when it’s obvious that the CD wasn’t aware of this new signing.

FisforFrank

Member

- Joined

- Aug 23, 2024

- Messages

- 16

- Reaction score

- 59

What is this collection? Pre Fall Women‘s?

Frederic01

Well-Known Member

- Joined

- Jun 7, 2021

- Messages

- 1,952

- Reaction score

- 4,868

CHECK THE TAG

PDFSD

Well-Known Member

- Joined

- Mar 27, 2024

- Messages

- 2,965

- Reaction score

- 10,537

PUCK NEWS

December 1, 2025

Everyone keeps asking me how it’s going with Jonathan Anderson at Dior. And I keep answering that it’s hard to tell thus far. It’s been six months. Very little of the product is in stores, and very early indicators suggest that Q4 luxury retail results will be soft in the U.S., where it seems like everyone is buying Gap pajamas and skincare. Then there are Anderson’s natural growing pains as he ascends from Loewe, which he transformed into a platform for his own unique talent, to a truly historic and code-driven brand—not to mention decidedly commercial—like Dior.

Of course, there will be customer attrition at his Dior, at least at first: On the women’s side, Maria Grazia Chiuri’s devoted clientele will migrate with her to Fendi; and somewhere on the men’s side, too. (There is a group of GLP-1-avoidant menswear customers who really love Kim Jones’s figure–flattering styles.) I’m confident that the Bar jacket in a Donegal tweed, which Anderson showed prominently during men’s pre-fall, can become a coveted, high-ticket item. Overall, though, I’ve heard mixed things from clients: Some are charmed, others feel that everything Anderson is offering—the slim chinos, deliberately tacky belts, worn jeans—can be found elsewhere, and continue to take a more hesitant, wait-and-see approach.

If Anderson is creating the best version of standards, they will sell. (I like the branded sweats a lot.) And that seems to be part of a strategy that is less concerned with the old ways of luxury—buying for the hype and the sake of buying—and more interested in tiny, beautiful things.

Anderson’s recent Instagram posts featured pages of jewelry and material details, which may appeal to a different kind of customer.

While Anderson’s success is going to rely heavily on support in China, it’s important to remember that there are dozens of different consumer segments within the region. The old customers may leave, but there are, hypothetically, ample new ones to replace them.

At least that’s the plan, but it underscores my own hesitancy to render a preemptive verdict. When I know more, you will know.

Meanwhile, I’m currently more interested in the movement at the LVMH group level, where questions abound about the ever-deliberated standing of some of Bernard Arnault’s longtime, near-retired deputies. What do their current and future deployments indicate about the long-term management of the company? And, of course, what does all this mean for the next generation? After all, LVMH shares are creeping back upward after a severe dip earlier this year, with support from analysts who have, for the most part, rated it outperform.

Arnault Country for Old Men

At LVMH, a series of anticipated executive shuffles may suggest the latest contours of a succession strategy. At the very least, it’s got the industry kremlinologists taking notice.December 1, 2025

Everyone keeps asking me how it’s going with Jonathan Anderson at Dior. And I keep answering that it’s hard to tell thus far. It’s been six months. Very little of the product is in stores, and very early indicators suggest that Q4 luxury retail results will be soft in the U.S., where it seems like everyone is buying Gap pajamas and skincare. Then there are Anderson’s natural growing pains as he ascends from Loewe, which he transformed into a platform for his own unique talent, to a truly historic and code-driven brand—not to mention decidedly commercial—like Dior.

Of course, there will be customer attrition at his Dior, at least at first: On the women’s side, Maria Grazia Chiuri’s devoted clientele will migrate with her to Fendi; and somewhere on the men’s side, too. (There is a group of GLP-1-avoidant menswear customers who really love Kim Jones’s figure–flattering styles.) I’m confident that the Bar jacket in a Donegal tweed, which Anderson showed prominently during men’s pre-fall, can become a coveted, high-ticket item. Overall, though, I’ve heard mixed things from clients: Some are charmed, others feel that everything Anderson is offering—the slim chinos, deliberately tacky belts, worn jeans—can be found elsewhere, and continue to take a more hesitant, wait-and-see approach.

If Anderson is creating the best version of standards, they will sell. (I like the branded sweats a lot.) And that seems to be part of a strategy that is less concerned with the old ways of luxury—buying for the hype and the sake of buying—and more interested in tiny, beautiful things.

Anderson’s recent Instagram posts featured pages of jewelry and material details, which may appeal to a different kind of customer.

While Anderson’s success is going to rely heavily on support in China, it’s important to remember that there are dozens of different consumer segments within the region. The old customers may leave, but there are, hypothetically, ample new ones to replace them.

At least that’s the plan, but it underscores my own hesitancy to render a preemptive verdict. When I know more, you will know.

Meanwhile, I’m currently more interested in the movement at the LVMH group level, where questions abound about the ever-deliberated standing of some of Bernard Arnault’s longtime, near-retired deputies. What do their current and future deployments indicate about the long-term management of the company? And, of course, what does all this mean for the next generation? After all, LVMH shares are creeping back upward after a severe dip earlier this year, with support from analysts who have, for the most part, rated it outperform.

hamburgers

Well-Known Member

- Joined

- Mar 25, 2025

- Messages

- 269

- Reaction score

- 1,161

What is this collection? Pre Fall Women‘s?

Is this the new clothes label for RTW? The sparsity makes it look more cheap than monumental that I'm assuming was the intended effect.

Nicole Kidman's daughter in the moire look

TianCouture

Well-Known Member

- Joined

- Jun 26, 2009

- Messages

- 1,339

- Reaction score

- 1,307

this writer....likes the branded sweats? are you f******* serious?

Monsieur Cristobal

Well-Known Member

- Joined

- Oct 27, 2024

- Messages

- 802

- Reaction score

- 3,575

Eight bad gowns in a row... the good one should be coming soon.

The one out of ten Dior rule.

The one out of ten Dior rule.

yslforever

Well-Known Member

- Joined

- Nov 13, 2021

- Messages

- 2,343

- Reaction score

- 8,184

What is this collection? Pre Fall Women‘s?

As the caption said, I really love all the details... they are really refined, that top with the pansies is incredible, the tweed, the 3D embroideries,

It's the full silhouettes that I dread.

Also I agree, communications need to follow the change of art directiion; Bialobos and Favier maybe out.

Similar Threads

- Replies

- 618

- Views

- 92K

- Replies

- 38

- Views

- 15K

D

- Replies

- 2

- Views

- 3K

- Replies

- 241

- Views

- 94K

Users who are viewing this thread

Total: 6 (members: 3, guests: 3)

New Posts

-

Numéro Tokyo January / February 2026 : Lindsey Wixson by Yusuke Miyazaki (6 Viewers)

- Latest: Toni Ahlgren

-

-

-

Vogue Sandinavia December 2025 / January 2026 : Pamela Anderson by Casper Sejersen (16 Viewers)

- Latest: KoV

-