You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

LVMH - The Luxury Goods Conglomerate

- Thread starter BerlinRocks

- Start date

PDFSD

Well-Known Member

- Joined

- Mar 27, 2024

- Messages

- 1,066

- Reaction score

- 2,937

yes part of it is the storywere these shares in LVMH hands from the time of their hostile takeover attempt?

Nimsay

Well-Known Member

- Joined

- Apr 13, 2023

- Messages

- 1,313

- Reaction score

- 1,923

LVMH is showing signs of groaning.

Dior's success has been revealed to be a Wizard of Oz illusion. Their profits were up because they used slave labor. This makes Delrina look bad since she was supposedly being groomed for CEO.

Now LVMH is stealing from Hermes?

Its clear that the kids are the usual rich kids and have no guardrails for behavior leading to crashing the company. They don't have their father's ability to move without making the industry hate you.

The documentary on Al Jazeera makes more sense now... Some Trillionaire princess was personally offended by LVMH on Hermes behalf and had that published.

Dior's success has been revealed to be a Wizard of Oz illusion. Their profits were up because they used slave labor. This makes Delrina look bad since she was supposedly being groomed for CEO.

Now LVMH is stealing from Hermes?

Its clear that the kids are the usual rich kids and have no guardrails for behavior leading to crashing the company. They don't have their father's ability to move without making the industry hate you.

The documentary on Al Jazeera makes more sense now... Some Trillionaire princess was personally offended by LVMH on Hermes behalf and had that published.

Olaffo

Well-Known Member

- Joined

- Sep 23, 2020

- Messages

- 490

- Reaction score

- 1,651

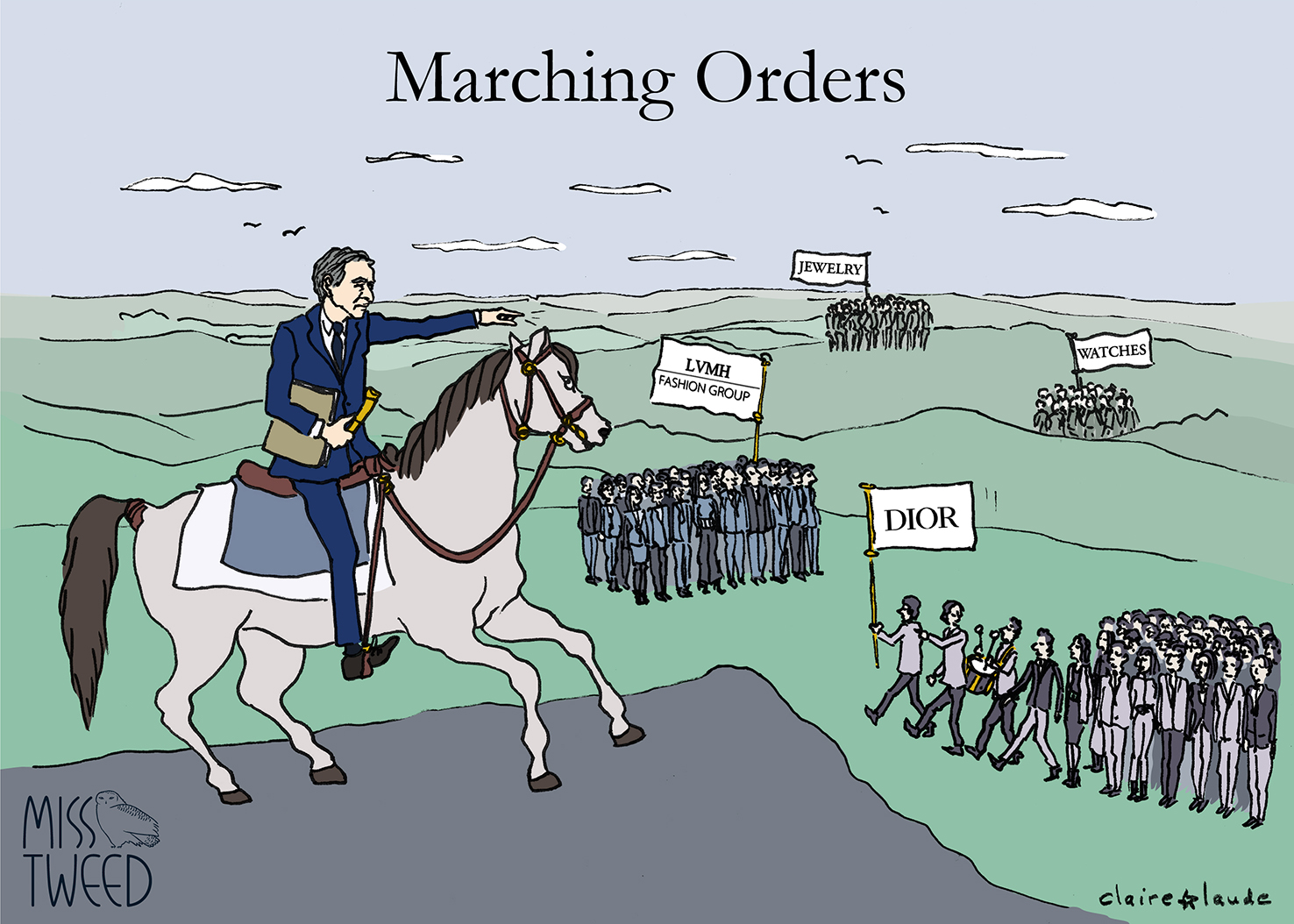

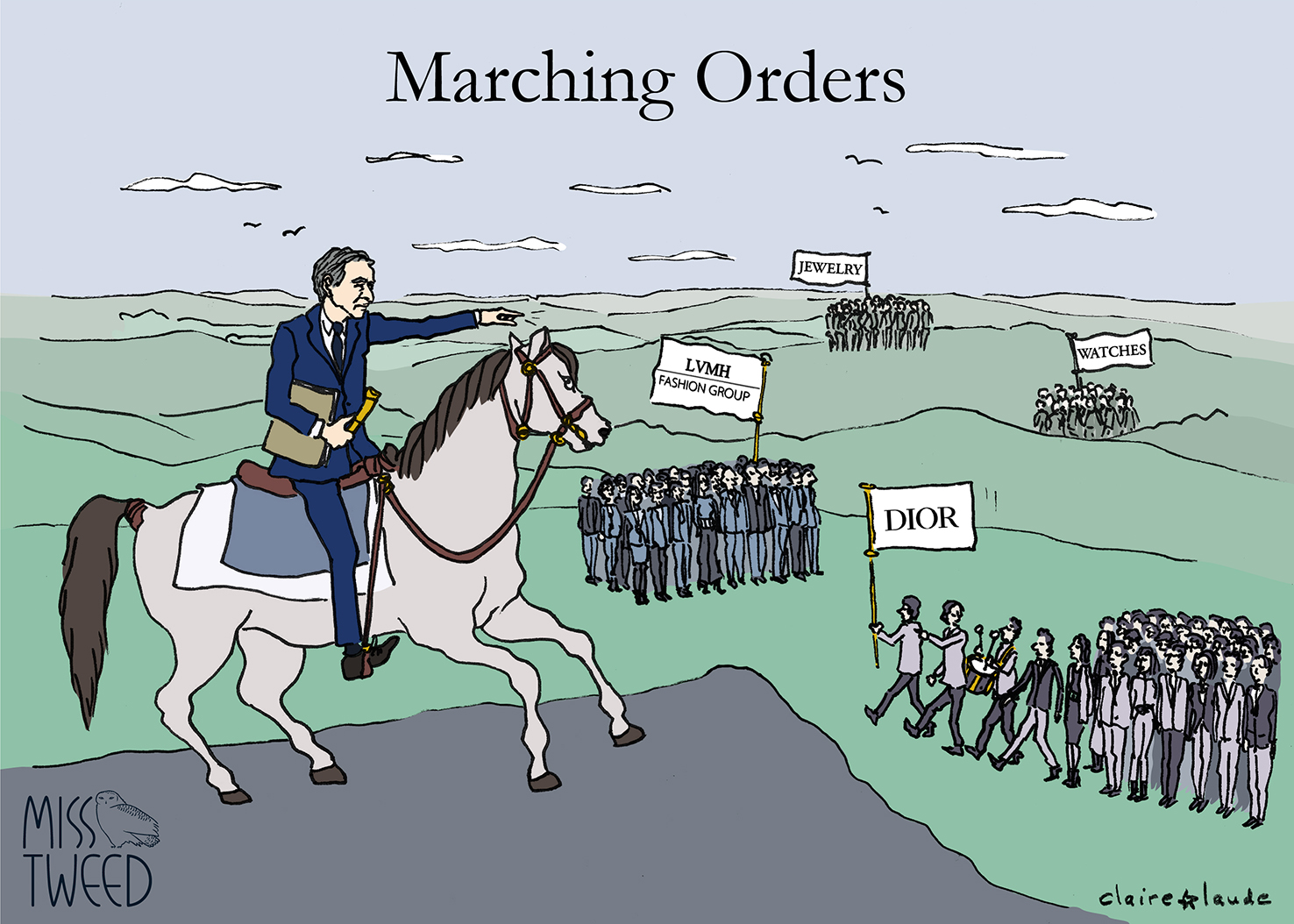

Bernard Arnault charges on with grand reorganization

The revamp of LVMH’s top creative and executive management is far from over and will last well into next year. LVMH, Chanel, Kering, Richemont as well.

If she is correct then we will definitely witness more musical chairs in 2025...

Can someone post the article for those of us who don't want to pay 35eur for a subscription?

Bernard Arnault charges on with grand reorganization

The revamp of LVMH’s top creative and executive management is far from over and will last well into next year. LVMH, Chanel, Kering, Richemont as well.misstweed.com

If she is correct then we will definitely witness more musical chairs in 2025...

PDFSD

Well-Known Member

- Joined

- Mar 27, 2024

- Messages

- 1,066

- Reaction score

- 2,937

that they then charge you double in one month and more people had same issues ..you have to then ask your money back lolCan someone post the article for those of us who don't want to pay 35eur for a subscription?

rivegaucheface

Member

- Joined

- Dec 19, 2024

- Messages

- 9

- Reaction score

- 21

https://archive.ph/ is a great resource for avoiding paywallsCan someone post the article for those of us who don't want to pay 35eur for a subscription?

Lauren Sherman did a "reader mail" issue of her Puck newsletter today, and someone asked why there is still no American version of LVMH:

Why is an American LVMH so difficult to achieve, besides the heritage of the brands and the fact that Arnault saw this all before everyone else did and his timing cannot be duplicated?

Lauren: I’m pretty sure I’ve answered this question before, but it’s a perennial one, so I’m happy to revisit it. The short answer is that the U.S. does not have the infrastructure to build pure luxury brands—the manufacturing capabilities, the talent pool, or the history. A proprietor could scoop up a bunch of well-known, all-but-dead American brands—say Geoffrey Beene, Bill Blass, and Willi Smith—but even if they attached cool designers and great marketers to each, there is no way to easily scale that without leather goods capabilities, and even then it’s increasingly difficult because of all the competition. When Bernard Arnault hired Marc Jacobs to design Louis Vuitton in the late ’90s, LV was already a pretty big brand. Who knows if it would work now.

Look at The Row, which got backing from the Wertheimers and others this past year. The Row could only grow to a certain point in the U.S. before it had to move a meaningful amount of its operations to Paris. As I’ve always said, brands and operators should not focus on replicating something that already exists—in fashion, and most other businesses, that strategy almost never works. Also, LVMH has changed, too. Arnault’s mission is no longer about resurrecting dead brands, but rather restructuring existing ones.

Why is an American LVMH so difficult to achieve, besides the heritage of the brands and the fact that Arnault saw this all before everyone else did and his timing cannot be duplicated?

Lauren: I’m pretty sure I’ve answered this question before, but it’s a perennial one, so I’m happy to revisit it. The short answer is that the U.S. does not have the infrastructure to build pure luxury brands—the manufacturing capabilities, the talent pool, or the history. A proprietor could scoop up a bunch of well-known, all-but-dead American brands—say Geoffrey Beene, Bill Blass, and Willi Smith—but even if they attached cool designers and great marketers to each, there is no way to easily scale that without leather goods capabilities, and even then it’s increasingly difficult because of all the competition. When Bernard Arnault hired Marc Jacobs to design Louis Vuitton in the late ’90s, LV was already a pretty big brand. Who knows if it would work now.

Look at The Row, which got backing from the Wertheimers and others this past year. The Row could only grow to a certain point in the U.S. before it had to move a meaningful amount of its operations to Paris. As I’ve always said, brands and operators should not focus on replicating something that already exists—in fashion, and most other businesses, that strategy almost never works. Also, LVMH has changed, too. Arnault’s mission is no longer about resurrecting dead brands, but rather restructuring existing ones.

Dior’s Women’s Business Is ‘Under Pressure,’ but Fixable: HSBC

A new report on luxury giant LVMH dives into creative and management changes, flagging Loewe's star designer Jonathan Anderson as a possible "eventual" successor to Maria Grazia Chiuri.

ByMILES SOCHA

JANUARY 10, 2025, 12:14PM

Backstage at Dior Spring 2025 Ready-to-Wear Collection at Paris Fashion WeekDELPHINE ACHARD/WWD

What should be the top of LVMH’s to-do list in a slowing luxury sector? Tackling so-called “greedflation,” explaining its recent rash of management changes, and fixing Dior, where the women’s business is “under pressure.”

So says HSBC in a new report on LVMH Moët Hennessy Louis Vuitton, which is due to report fourth-quarter sales in the coming weeks.

The bank maintains a “buy” rating on the stock and is forecasting a “slight improvement” at group level — a 2 percent decline, versus 3 percent in the third quarter — and at its linchpin fashion and leather goods division: a 4 percent erosion versus 5 percent for the previous quarter.

“We remain convinced, for the sector as well as for LVMH, that Chinese consumption has not deteriorated further since Q3 2024, while American consumption of luxury has picked up convincingly since the early November 2024 election,” said the report, which lists as authors the analysts Erwan Rambourg, Anne-Laure Bismuth and Aurelie Husson-Dumoutier.

It also noted that LVMH is the luxury group that is most exposed to the U.S. consumer — therefore the biggest winner from any improvements — and the biggest beneficiary from recent strength in the U.S. dollar.

The report also addressed head-on a slowdown at Dior, which it ranks as the group’s biggest contributor of profits at the level of earnings before interest and taxes after its flagship Louis Vuitton brand.

HSBC estimated revenues at Dior almost quadrupled from 2.7 billion euros in 2018 to exceed 9 billion euros in 2023 — comparative to the explosive growth Gucci experienced under designer Alessandro Michele, growth that quickly fizzled and has yet to improve under his successor, Sabato De Sarno.

“’Does this make Dior the next Gucci?’ is a question we are often asked,” the report said. “Our view is that it is absolutely not the case because management focus and brand investments have been unwavering and the brand has not had a major creative shift like at Gucci. Moreover, some would argue that Dior is less fashion-driven.”

That said, HSBC argued that designs from Dior have become “a bit stale and repetitive,” with men’s goods by designer Kim Jones “doing well still” and women’s goods by Maria Grazia Chiuri “under more pressure.”

“Based on our seven-year rule, it could be time for the brand to shift designers for the latter,” the report said, flagging the possibility that Loewe’s fashion star Jonathan Anderson “could take over from Ms. Chiuri eventually.”

HSBC argued Dior — like Saint Laurent and Burberry — drove up prices too quickly in recent years, alienating many luxury consumers. It expects the fashion house to “work on new collections that offer a better value proposition” rather than lowering prices.

It also applauded the recent recruitment of Miu Miu chief executive officer Benedetta Petruzzo as managing director of Dior Couture, which “could enable a brand reboot, focusing on innovation and product creativity, without changing designers.”

HSBC said a recent rash of management changes at LVMH at the corporate level, and its wines and spirits division, also ranks as a top investor concern.

“Our take overall is that the group is not reacting to external pressures (weak sales), rather, going through teething issues as there is an assumption that control will eventually trickle down from the current CEO, Bernard Arnault, to his five children, who are all employed by the group,” said the report, characterizing concerns as “premature” as Arnault, 75, recently extended his leadership mandate to age 80.

“Given the quality of managers within the group as well as the experience of all five Arnault descendants…we believe the group has many qualified future leaders in-house and has, if needed, the potential to attract more talent,” it said.

Similar Threads

- Replies

- 3

- Views

- 1K

- Replies

- 2

- Views

- 2K

- Replies

- 3

- Views

- 721

- Replies

- 48

- Views

- 9K