excerpts from wwd story about uniqlo's expansion plans and how stores will be stocked. it does seem as if they are pinning their hopes on expanding designer wares...the new store sounds amazing...cant wait to check it out this weekend...

Uniqlo Looks to SoHo Flagship for International Rebound

By Sharon Edelson

The SoHo unit will be the largest Uniqlo store in the world and will span three levels, including the basement and first and second floors. The merchandise mix was directed by the company's New York research and development center.

The flagship's theme of Modern Japan, as interpreted by Uniqlo creative director Kashiwa Sato and interior designer Masamichi Katayama of Wonderwall, features contrasting finishes, open spaces, walnut floors and painted tin ceilings.

The flagship combines the building's historical features with new technology. A "history wall" of exposed brickwork and pipes is preserved behind glazed glass. In the center of the store, a two-story glass atrium showcases about two dozen mannequins, which are resting on a rotating glass floor. Adjacent to the atrium is a glass elevator in a glass shaft.

A wide mezzanine clad in wood has glass and stainless steel portals for displaying clothing. A gallery space exhibits T-shirts designed by top Japanese artists such as Yayoi Kusama, Nobuyoshi Araki, Takashi Honma, Osamu Tezuka and Godzilla. There are more than 100 different T-shirts designed by 40 artists, as well as complementary artwork, books and CDs.

The flagship may be a showstopper, but the success of the store will depend on Americans' appetite for Uniqlo's clothes. For the most part, the women's wear is sturdy and utilitarian, with little or no embellishment. For example, for fall, there are lambswool turtleneck sweaters for $29.50; tweed shorts, $49.50; skinny jeans, $39.50; velveteen jackets, $79.50, and peacoats, $89.50.

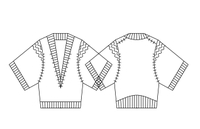

Retail analysts said Uniqlo will have to inject more fashion into its designs if it is to succeed in the U.S., and the company is making some efforts to that end. The retailer recently tapped Lutz & Patmos, Kino, Alice Roi, Phillip Lim and GVGV to design capsule collections for women as part of its spring Designer Invitation Project, which is being launched in conjunction with the SoHo store opening. It's not a new concept. H&M has hired designers such as Karl Lagerfeld and Stella McCartney, and on Thursday, Viktor & Rolf's collection for H&M bows. Meanwhile, Target has brought class to the masses with the Isaac Mizrahi label and Go International, its program of rotating designers such as Luella Bartley, Tara Jarmon, Sophie Albou and Behnaz Sarafpour.

"For Uniqlo to sustain interest, it's going to have to up the ante in fashion credentials," said George Wallace, chief executive of Management Horizon Europe. "It resonates with where they're moving with their young designer program. It's not a case of fashion being nice to have. They need to have fashion if they're going to succeed."

Fast Retailing, which has expressed interest in acquiring a U.S. retailer, is intent on opening flagships in London, Paris and Shanghai. The company also believes it has a lot of growth left in Japan.

Uniqlo, which has almost 700 stores and had sales of $3.5 billion last year, entered the U.K. in "a blaze of glory," said Wallace, adding the retailer opened stores in high-profile locations such as Knightsbridge near Harrods. Finding it difficult to compete with H&M, Tesco and Asda, Uniqlo scaled back its store count to eight from a peak of 21 in 2002.

"People realized this is basically fairly ordinary, reasonable-quality clothing," Wallace said. "After the initial curiosity value, as it were, Uniqlo found itself rather exposed and not performing well. Since then, they've regrouped and developed the product. There's a bit more fashion content. Uniqlo is gradually reopening stores in high-profile but mass market locations. They're understanding this marketplace better."

This would appear to be a precarious moment to enter the American apparel market with basics. Gap and Old Navy, two of the most successful retailers in the field, have been struggling. According to Todd Slater, a retail analyst at Lazard Capital, consumers aren't looking for more basics. "The Gap is getting left behind simply because it has been too safe in terms of the fashion choices it has made," Slater said. But Slater said Uniqlo could steal market share from Gap. "If Uniqlo produces more timely, relevant fashion basics at favorable price points, it would contribute to more erosion of share for Gap and Old Navy," he said.

Candace Corlett, a principal at WSL Strategic Retail, said, "The issue for Uniqlo is going to be to distinguish itself. More inexpensive stuff without a strong design statement is going to be a challenge. SoHo's a different market and it's going to need a little more of a fashion look and statement. Their success is going to depend on the distribution and where they place the stores."

). I was wondering if anyone has seen the next collection in new york yet though... I'm gunna be hooked on uniqlo if it's all as lovely quality as the pieces I got