Once the domain of rock stars and royals, men’s jewellery has become an increasingly dynamic and valuable market.

LONDON, United Kingdom — In the 12 months ending May 2014, sales of men’s accessories grew 9 percent, reaching $13.6 billion and capping a two-year period that saw the category grow 13 percent, according to market research company NPD Group. Ecce Homo! The much-anticipated growth in the men’s accessories market is here. And jewellery has emerged as a crucial category.

Mining growth

“Our men’s jewellery business is a key growth area in what has become an overarching strategy for Barneys to grow the men’s accessories business. The new-found interest in men’s jewellery is a lasting trend; I see growth potential and a need to continue to challenge our buyers to find new and exclusive designs to satisfy demand from this sophisticated consumer,” said Tom Kalenderian, executive vice president and general merchandise manager at Barneys New York.

Indeed, the opportunity in men’s jewellery has not gone unnoticed by the industry’s biggest brands. Bottega Veneta, Saint Laurent, Versace and Givenchy, in particular, have made forays into the category in recent years.

“A lot of the big brands have realized they do need accessories and jewellery alongside their clothing — and also to accessorise their shops,” explained Robert Tateossian, chief executive of London-based jewellery brand Tateossian, founded in 1990 and now available in 71 countries at over 1000 points of sale. “We [provide private label for] Zegna, Canali, Gieves & Hawkes, and then we also do most of the department stores like Harrods and Saks.”

Independent labels are also seizing the opportunity. “We have experienced double-digit year-on-year growth in our men's business since it launched in 2002, but this growth has accelerated over the past three years,” said Courtney Crangi, chief executive and co-owner of Giles & Brother, an accessibly-priced costume and silver jewellery brand, based in New York. “There are a lot of brands doing work within a similar price point and with a similar attitude, and I know that there are more everyday. The market is expanding really rapidly… People are just buying more and more jewellery,” added Philip Crangi, co-owner and creative director of Giles & Brother.

“Our jewellery business has grown exponentially and we are forecasting continued growth in the coming year,” agreed Simon Spiteri, head accessories buyer at luxury men’s e-tailer Mr Porter.

Shifting social attitudes

The expansion reflects growing social acceptance of men’s jewellery. “If you go back 15 to 20 years, the only men who were wearing jewellery were pretty much rock stars and other musicians; heavy chains and big rings, that whole Chrome Hearts look. The shift that we gradually started seeing, probably because of the rise of the metrosexual man, was that it became acceptable for men who are not rock stars to start wearing jewellery,” said Tateossian.

“I think, in the mid-1990s, we saw the beginnings of a rise with the influence of music culture; hip-hop and rock played a huge part in this. It was also born out of the rise of celebrity culture, with influencers such as David Beckham having a notable impact on the way men dress. He’s a huge advocate of accessorising and this ultimately filtered through to the consumer,” added Spiteri.

Bracelets, bracelets, bracelets

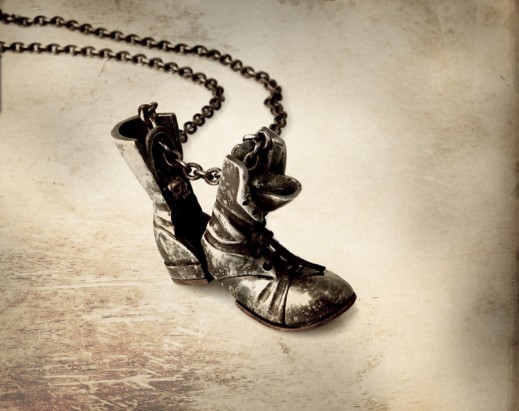

In recent years, men’s buying habits have also moved well beyond the traditional confines of the category, namely watches, wedding bands and cufflinks. “The business of men’s jewellery went dormant post-1970s; the Wall Street power dressing trend was more buttoned-up. What [we see] today is men’s newfound passion for wearing jewellery again as a means of personal expression,” said Kalenderian.

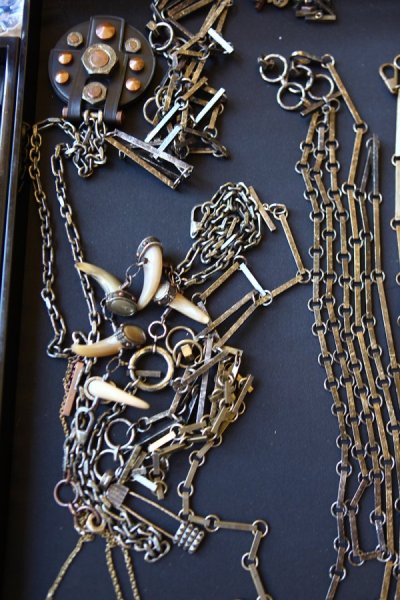

Nowhere has this passion been more evident than on men’s wrists. “Bracelets, bracelets, bracelets, piled up on wrists evoking memories of distant travels to exotic vacations. Today, this newfound comfort level for men to wear their style on their sleeve is infectious,” added Kalenderian.

“With bracelets it started with rock and roll, only heavy bracelets, then it became leather and silver and very little thin bands, and then elastic bands that are always linked to a charity, like LiveAid, etcetera. Now you see a wide array of bracelets. You can go into Zara and there is a wide selection of bracelets against the wall, or you can go into a designer shop and you’ll have leather and silver,” explained Tateossian.

“Our accessories category is a big growth area across the board, but over the last few seasons jewellery — more specifically bracelets — has shown huge potential. Jewellery like this used to be more successful in more traditional metals, but now we’re seeing a rise in alternative materials such as leather,” said Spiteri.

“If you measure the growth of bracelet sales in the market — and unfortunately there is no data to support that — I believe you would see it growing by 5 to 7 percent per year. It’s a fashion audience which is much, much bigger than cufflinks, for example,” said Tateossian. “The bracelet has become a different thing; it is a lot more emotional, it means something, it is not just about the value of what you are wearing on your wrist,” he continued.

Indeed, once expressions of status, bracelets have become talismanic expressions of identity, crafted in a variety of materials, to suit every budget. What’s more, the wrist is especially popular, as this part of the body was long ago made safe for accessorizing by the watch. Today, however, men are increasingly buying multiple items — not just a single watch — to outfit their wrists.

“I think of [our consumer] as stacking pieces, so I want to give him something that he can wear with the pieces he already has,” said Crangi. “Our price point is a fairly low price point and I see [our] guy buying multiples and I definitely design to his needs.”

Kalenderian agreed: “Men, who once dabbled in a piece or two, are now collecting jewellery and mixing pieces. Multiple layers of bracelets and mixing charms on chains and cord necklaces are emerging as a new trend and interest in [men’s] jewellery.”

“I think men are more open to owning a variety of pieces, not just one piece they wear for all occasions, so they are buying more,” said Michael Saiger, founder and creative director of Miansai. Founded in 2008, the Miami-based bracelet brand is known for its anchor motifs and clasps, has a retail presence in 36 countries and has expanded into leather goods and watches. “I think things like men’s necklaces and rings are categories that we will see grow,” added Saiger.

Growth across segments

As well as buying more jewellery overall, men also are willing to spend more per piece. “With all the attention to the category, the perception has really changed. Men see jewellery as an extension of their style, like a watch, so they are willing to pay more for the right pieces. We are seeing more customers gravitating towards our cuff styles. They are a bit more substantial, more expensive,” said Saiger.

“We are talking about elevating our price point with materials. Right now, what we do is predominately brass and leather, we do some pieces in silver, we are adding gold into the mix; I think people are ready for that. I think people are starting to want to spend a little bit more on something that has that material value,” said Crangi.

Tateossian has also expanded its top end collection. “Traditionally our bracelet line was always sterling silver, that was the segment I wanted to be in and then at one point I realized, ‘You know what, I am missing out people that want something super expensive and want something with diamonds.’ So we started fragmenting the line, so there is a very small collection which is 18 carat gold and leather and that is a growing segment. We are selling a lot more gold than we ever did before.”

“We are selling more gold and precious stones, but in an understated way,” added Kalenderian. “The Barneys men’s jewellery client is more likely to opt for black diamonds or matte finished stones surrounded by hammered and oxidized metals; bling without the bling. The collectability certainly indicates that medium price points are the growth area, but as collectors become more sophisticated, they experiment with some precious metals and stones.”

Brands are betting on growth at the lower end of the market as well. “Similarly, we went down a notch and introduced a line called RT by Tateossian, which is non-silver, instead we use aluminium,” said Tateossian. “You have a younger audience picking that up, so depending on your age, depending on your income, you can go in and pick whatever suits your pocket.”

A ceiling well below the women’s market

Though the men’s jewelley market is growing, “it will never equal women’s jewellery,” said Crangi. “It sort of turns sexual politics on its head when you look at it; men are much, much fussier than women about their jewellery. You need to woo them and convince them it is a safe place. Women are much freer about it. They are used to transforming themselves and presenting themselves in different contexts, men are not so fluid,” he continued.

“This category will never equate to the market for women,” echoed Tateossian. “To give you an example, last week, I happened to sit next to one of the biggest entrepreneurs in the world of retail. He owns every brand you can imagine. I asked if I could see what cufflinks he was wearing; they were silk knots. The man was worth billions of dollars. There is definitely growth [at the top end of the market], but it will never be the same as it is for women. Even if they are driving a Bentley and wearing a custom made suit that costs $25,000, they are happy to wear silk knots on a day-to-day basis.”