jeanclaude

Well-Known Member

- Joined

- Feb 12, 2012

- Messages

- 3,918

- Reaction score

- 10,194

Wow! Black and gold to give a luxury feel! Groundbreaking...

Live Streaming... The F/W 2025.26 Fashion Shows

Watch Live & Comment... The 2025 Academy Awards!

Source: BoFCan Celine Work Without Hedi Slimane?

After growing the brand’s annual sales to nearly €2.5 billion, the star designer has been locked in a thorny contract negotiation with owner LVMH that could lead to his exit, sources say. BoF breaks down what Slimane brought to Celine and what his departure could mean.

By ROBERT WILLIAMS

23 April 2024

BoF PROFESSIONAL

PARIS — For months, Celine designer Hedi Slimane has been engaged in a thorny contract negotiation with owner LVMH that could lead to the designer’s departure from the brand, sources familiar with the matter say.

Since LVMH chairman Bernard Arnault installed Slimane six years ago, the star designer has transformed Celine, launching menswear (leaning into his trademark skinny silhouette), perfume and, most recently, beauty, in addition to reconnecting its womenswear image to the house’s historic identity as a purveyor of leather goods that incarnate Parisian bourgeois style.

At first, sales dropped as Slimane pivoted sharply away from predecessor Phoebe Philo’s minimalist, arty look. But since the pandemic, Celine’s business has surged to record highs. While owner LVMH does not regularly disclose sales for individual brands, Celine’s revenues surpassed €2 billion ($2.1 billion) in 2023, the company told investors in January. The brand’s full-year results were likely closer to €2.5 billion, meaning it had surpassed Fendi to become LVMH’s third-largest fashion label, behind only Louis Vuitton and Dior, according to HSBC.

Despite the strong results, sources say Slimane may be on the way out, adding credence to a recent report by Miss Tweed saying Slimane is set to leave the brand. Representatives for LVMH and Celine declined to comment.

The Two Sides of Hedi Slimane

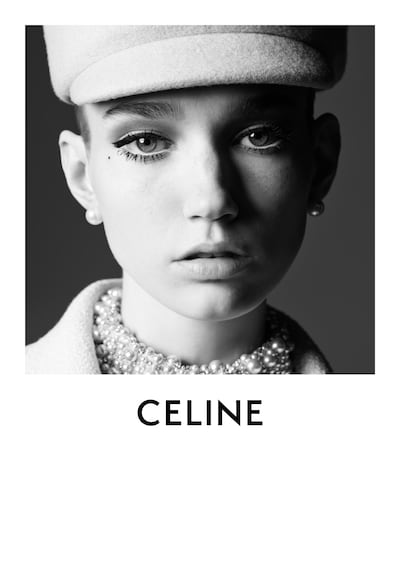

Slimane is a rare talent. Known as the industry’s best stylist, he has generated perfectly precise fashion images since his trendsetting turn at Dior Homme in the early 2000s, when he helped usher in a decade-long trend cycle with his skinny silhouette. His approach to branding and merchandising invokes the strategies of French fashion heavyweights, with ultra-consistent, minimalist art direction that echoes Karl Lagerfeld — especially when shooting Celine’s black-and-white campaigns himself — and commercial collections that blend street style and luxury à la Yves Saint Laurent.

“Hedi is a genius of marketing, product and merchandising. He knows how to create that jacket, that shoe,” said Alice Bouleau, partner at executive search firm Sterling International. “It’s not overly intellectual; it’s not as subtle as what Phoebe was doing, but he really grasped the essence of what this brand was about.”

But Slimane’s considerable talent has come with financial and creative demands to match.

In addition to commanding what’s understood to be a historically high salary for a designer, he’s also notorious for seeking royalties on all manner of creative output from campaign images to perfume formulas and more.

A true auteur despite his commercial savvy, Slimane expects complete creative control over a broad sweep of subjects — not just what goes in collections, but when and how they are shown, as well as to whom, and the environment in which they are sold.

That can lead to big results and fast, but only when the investment dollars are flowing freely. Since Slimane joined Celine, teams have spent countless hours, and company funds, ferrying samples back and forth to his home in St. Tropez, where he regularly holes up. Projects often reach an advanced stage before getting axed by the reclusive Slimane, creating frustration and high turnover in senior teams.

Shows and media can also be a sticking point. The brand has largely eschewed in-person runway shows in favour of fashion films that take months and millions of dollars to shoot. These are then released online without warning, limiting opportunities for editorial coverage (and, ultimately, visibility with consumers). When Slimane does stage an in-person show, influential guests are often absent. In addition to favouring off-calendar presentations at moments when editors and influencers are not around, since 2021 the brand has outright boycotted Vogue and its sister publications at Condé Nast in protest of the company’s cost-cutting move to oust regional editors-in-chief, including his longtime friend and collaborator Emmanuelle Alt, formerly editor-in-chief of Vogue Paris.

Slowing Market

As luxury’s demand cools following a multi-year surge, it may be difficult for LVMH to justify the investment Slimane requires at one of its smaller brands. LVMH’s fashion and leather goods growth slowed to 2 percent in the first quarter, its slowest quarter since 2020.

“There’s a normalisation of growth right now that has led LVMH to become more cost-conscious. It could be more difficult to justify having a small brand where [the designer] is getting whatever they want; it can create tensions,” HSBC analyst Aurélie Husson-Dumoutier said.

The idiosyncratic creative rhythm at Celine won’t make it easy for teams to navigate a rocky luxury market. The brand’s latest collection, inspired by Paris in the 1960s and the Arc de Triomphe, was dropped in a fashion film in mid-March. The slick collection of baby-doll dresses and riding hats made for an eye-catching departure from Slimane’s usual fare at Celine, which leans more often into denim- and shearling-heavy references from the 1970s. But it’s unclear whether clients will take notice. Nearly 150,000 people have streamed the video on YouTube, far fewer than for the show footage of similar-sized brands that staged physical activations during fashion week. (Loewe logged 375,000 views; Saint Laurent more than one million.) The brand hasn’t staged a physical event since January last year.

Slimane may have his own motivations for parting ways with Celine: He could have another, bigger job lined up — inside or outside LVMH — or he could simply want to do other things with his life. Following his tenure at Saint Laurent, Slimane took owner Kering to court to prevent the group from scrapping his lengthy non-compete, allowing him to bring in a multi-million dollar salary while not working in fashion for three years. The designer lived primarily in Malibu and focused on his photography practice.

Celine After Hedi

A unique talent Slimane may be, but Kering’s Saint Laurent offers a case study in how a brand can continue to thrive in his wake. Following the designer’s 2016 departure, the brand gradually updated its womenswear collections and products under his successor, Anthony Vaccarello. But much of the framework that Slimane put in place, including pared-back branding, a monochromatic store concept and a skinny, rocker silhouette for men, remained in place as sales roughly doubled to €2 billion in the three years following his exit.

LVMH could take a similar tack at Celine should Slimane leave the brand. The template he has put in place at the label is commercially potent and broadly relatable, yet still differentiated: with an accessories program that has conquered Millennial bourgeoises far beyond Paris. The look is more grown-up than rival Saint Laurent, and more urban than Chloé's. While plenty of contemporary brands specialise in Parisienne wardrobe dressing, Celine is the only one to do so convincingly in the luxury space, and to style its wares with such a high-fashion touch.

LVMH could certainly slot in a new designer to add a dose of innovation and accelerate the pace of communications while sticking to its core branding and commercial strategy. Plenty of buyers of Celine’s Triomphe bags and monogrammed canvas cardholders are unlikely to know who Slimane is, after all, even if they appreciate the brand he’s effectively made his own.

“Hedi has set such a clear formula that someone else could continue to build on it, even someone who’s not as much of a star designer,” headhunter Bouleau said. A bolder approach to succession could also pay off, “but would be a big risk.”

“LVMH tends to put less emphasis on the designer — it’s always the brand that comes first,” HSBC’s Dumoutier said. “What Hedi has put in place can survive him.”

On the other hand, much of Slimane’s magic is in the execution. Updating and reissuing vintage pieces from lines like YSL Rive Gauche and its contemporaries is Slimane’s modus operandi — but they are styled and shot with a luxurious sheen. Losing Slimane the designer also means losing Slimane, the stylist and photographer. Those are enormous shoes to fill.

Luxury Turf War

Whether Hedi ultimately moves on or stays, it won’t have been an easy negotiation for LVMH and its chairman Bernard Arnault, who is seeking to balance a long-term vision for elevating his brands with cost-cutting efforts to protect the company’s bottom line in a slowing market.

After decades of snapping up luxury houses and real estate to expand his edge on competitors, 75-year-old Arnault and his children have become increasingly focused on retaining their access to creative talent, as well. Where star designers used to cycle in and out of LVMH and rival groups, in recent years the company has increasingly sought to move designers around within its ranks (as in the case of Kim Jones, who led Louis Vuitton menswear before taking on Dior Homme, then eventually adding Fendi womenswear to his duties).

LVMH may feel even more pressure to keep Slimane after talks with another rare talent — Alessandro Michele — fell apart, according to sources, leading the former Gucci designer to take up a role at Mayhoola’s Valentino. Meanwhile, LVMH’s Givenchy label has yet to name a designer since parting ways with creative director Matthew Williams in January.

BOF is not that desperate to follow Miss Tweed, come on you think LVMH has zero input on what agenda BOF pushes, nothing more than getting ahead of the news than BOF completely ignoring it, LVMH might have asked BOF to delay this article at the very least.Either BOF journalists are lazy and based an entire article out of speculations made by the MissTweed IG or those articles are conscious leaks made to help Hedi to negotiate the terms of the contract.

I repeat it. If Hedi leaves Celine, he will probably leave fashion all together because nobody in this industry will give him that level of control over a brand.

Arnault mentioned the success of Celine not so long as last week and investments are made in beauty, new launches in fragrances…etc.

Loewe and Celine are the growing brands so the top priority now as Dior and LV will have less spectacular growth.

Celine will survive Hedi ultimately but I don’t believe a departure now.

And seriously, the reasons evoked are ridiculous. When was the last time Hedi worked from Paris? So why now, having a studio in St Tropez would be an issue? Even more that St Tropez is closer to Italian factories than Paris would ever be…

So LVMH wants him to return to office while he is just fine working remote. Many such issues.

LVMH should shut the f*ck up and buy Hedi a helicopter so he can transit quicker.

The only good outcome would be for the Arnault to suck it up and bend over. Replacing him really won't be easy, especially at Celine which doesn't have very strong design codes.

Celine needs to return to physical shows. Lots of the mainstream recognition a fashion show gets comes from those who follow the celebrities who attend. While four shows at Paris would be the most conventional strategy, they could pull a page out of Jacquemus' book and opt for a mix of Paris and destination shows. For example, their next 18 or so months could be like this:

- AW24 Menswear through a film to get it out of the way

- SS25 Menswear on-schedule in Paris to regarner hype

- SS25 Womenswear in St-Tropez

- AW25 Menswear in London

- AW25 Womenswear in Paris again

- SS26 Menswear in Monaco

- SS26 Womenswear in Venice

They could rework their campaign strategy to highlight specific products and lines on top of their main collections. For example, they could do two larger campaigns for the Summer and Winter collections, with smaller campaigns for the "Grands Classiques", "Triomphe" and "16" lines in between. Their "Haute Parfumerie" and "Beaute" lines could be promoted via film starring Danielle or Lisa. The next step could be the launch of a cologne or a skincare line with "V" as the face.