I checked tbe website today, its already all polyester-mix materials, difficult to go cheaperIn theory, shifting the price point is probably what is needed to regain sales, however, at this point I find it hard to imagine Lee being cool with now having to now use cheaper fabrics or manufacturing or both in order to maintain healthy margins. It’s a very different mindset having carte blanche and having the suits forcing you to use cheap polyester instead.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Daniel Lee - Designer, Creative Director of Burberry

- Thread starter dodencebt

- Start date

rowjellies

Well-Known Member

- Joined

- Jun 25, 2024

- Messages

- 237

- Reaction score

- 700

I wonder if the leather goods are no longer gonna be Made in Italy / if they’re going to move production to China.

PDFSD

Well-Known Member

- Joined

- Mar 27, 2024

- Messages

- 2,388

- Reaction score

- 8,462

I agree absolutely: no AI generated vibes, that's why i said the creative approach is too mismatched and not clear what it stands for, the brand needs focus and like you said less quirk but keep it fashion ....my personal ideal is as well classic Burberry Britishness with fashion twists ....unexpectedness in doses not overkill.But nobody wants AI generated collections either.

I think Lee should continue on the path he is going in terms of elevated, fashion forward designs even if they have a classic flair.

Because he has to win the fashion game in order for the mass to follow.

If the Bailey era that people miss so much (people missing the past they never purchased anyway) was that successful in the last few years, he would have been at the helm of the brand at the moment.

Maybe less quirk like duck beanies but still fashion.

Burberry was more expensive than Saint Laurent in the first season despite the wave reviews and the clear excitement around Lee’s arrival.

A Burberry trench shouldn’t cost the same price as a Louis Vuitton one.

So it’s fair to fire The CEO as he is responsible or the strategy and pricing is part of the strategy. The job of the CEO is to support and highlight the talent, not the way around. That’s why he was fired. Results are mandatory in his contract…They aren’t in a designer’s contract.

If Lee has to leave, it will be after his contract ends.

The reality is that I think Burberry customers were totally aware that the brand is not a classic luxury house.

Even if i understand Bailey´s Burberry, i don't like it personally it's Frida / Gucci TF descendants ) way of design for a brand i found even then stuffy.

And nostalgia makes people forget the final year it was so formulaic and cheesy it was painful to watch nad if he was so great he would still be there like you said.

And agree the CEO sets the business strategy a creative director might have his 2 cents at the start or interfals, but usually they are hired with a plan in mind already to brief the new CD of the brand positioning, but it depends on the brand and culture and relationship of CEO and CD and the board members.

I do believe it went hand in hand with Daniel Lee because he came from BV and they wanted this type of profile to support the business plan of further elevation post Tisci.

PDFSD

Well-Known Member

- Joined

- Mar 27, 2024

- Messages

- 2,388

- Reaction score

- 8,462

We have China in Italy ( no joke ) , it won't change the price of cost , and there are good and bad factories in Italy as in ChinaI wonder if the leather goods are no longer gonna be Made in Italy / if they’re going to move production to China.

yslforever

Well-Known Member

- Joined

- Nov 13, 2021

- Messages

- 2,288

- Reaction score

- 7,919

If they are made in Prato, it's the same thing.I wonder if the leather goods are no longer gonna be Made in Italy / if they’re going to move production to China.

The Chinese Workers Who Assemble Designer Bags in Tuscany

Many companies are using inexpensive immigrant labor to manufacture handbags that bear the coveted “Made in Italy” label.

Last edited:

jeanclaude

Well-Known Member

- Joined

- Feb 12, 2012

- Messages

- 4,617

- Reaction score

- 13,359

They could lower the price as much as possible...but if Lee keeps making duck prints clothes, and his usual weird stuff, they won´t be able to get rid of the collection even if they offered it for free.

PDFSD

Well-Known Member

- Joined

- Mar 27, 2024

- Messages

- 2,388

- Reaction score

- 8,462

No need to bet it's common knowledge and in past prada dolce armani gucci, even max mara with unethical chinese fur farms.If they are made in Prato, it's the same thing.

Dior just got caught, but if Dior does it I am willing to bet they all do it.

The Chinese Workers Who Assemble Designer Bags in Tuscany

Many companies are using inexpensive immigrant labor to manufacture handbags that bear the coveted “Made in Italy” label.www.newyorker.com

chinese and italian industries for fashion are very much linked every few years its all in the news then disappears the hype, also african immigrants that work in tanneries with no protection and health care and little pay , if you see the area´s you would think it's anywhere but Italy.

The subcontractor game these luxury brands play are not new, even designers know as they work with factories what goes where and how it works, people talk but among there inner circles because they all have salaries that are provided by the industry and you even have italian families that work for one brand in varies levels so its not common you don't have whistleblowers in fashion in this part of the chain.

PDFSD

Well-Known Member

- Joined

- Mar 27, 2024

- Messages

- 2,388

- Reaction score

- 8,462

15 July 2024

BoF PROFESSIONAL

On Monday, Burberry named a new CEO — Joshua Schulman, the former leader of Coach, then Michael Kors — after comparable retail sales tumbled 21 percent in its first fiscal quarter.

The British luxury brand’s latest attempt to push upmarket under chief executive Jonathan Akeroyd and creative director Daniel Lee has struggled to gain traction in a slowing, polarised luxury market, prompting chairman Gerry Murphy to bring in new leadership.

While investors responded favourably to the move, it’s unclear how radically or how quickly a new CEO will reignite excitement in the Burberry brand after years of turnaround attempts.

An initial call with Murphy suggested the company will stick with its long-term brand elevation strategy — and current designer — while at the same time taking “decisive action” to rebalance its marketing and products to include more accessible propositions.

BoF breaks down what the shake-up means for Britain’s biggest fashion brand, and the luxury industry at large.

But for more than a decade, Burberry’s top-line revenues have been broadly stagnant, despite surging demand for luxury fashion, at first among Chinese Millennials from 2016 to 2019, and then as sales in the US and Europe boomed in the aftermath of 2020′s coronavirus pandemic.

2023 revenue of £2.97 billion ($3.86 billion) was flat year-on-year. But in the past two quarters, Burberry has gone from stagnation to steep decline. Comparable retail sales fell 21 percent year-on-year in the quarter ending June 29, following a 12 percent decline at the start of the year.

“The weakness we highlighted coming into [fiscal year] 2025 has deepened and if the current trend persists through our Q2, we expect to report an operating loss for our first half,” chairman Gerry Murphy said. “In light of current trading, we have decided to suspend dividend payments.”

But Akeroyd’s strategy for the company was being implemented at the same time as a post-pandemic luxury wound down, and the company made a few key missteps during the transition from former designer Riccardo Tisci’s bold-faced, streetwear-inflected vision to the first collections by current creative director Daniel Lee.

Burberry’s first collection under Lee appeared to give free reign to the designer’s sensual, textural, pop take on British luxury, helping to quickly update the brand’s image. But Lee’s offering came with eye-popping price tags that alienated aspirational customers.

New ranges of supple leather bags like Shield and Knight were priced at nearly $3,000, limiting their audience, while cool show pieces like duck- and fox-shaped beanies came in at $4,500. Chunky block-heeled loafers or Timberland-inspired nubuck “Trek boots” failed to take off when priced above $1,000, and have since been marked down over 50 percent by Saks and Neiman Marcus.

Burberry has since worked to fill in its offer with more accessible propositions, but many items are still priced too highly to attract a new cohort of clients at a brand whose starting point is the trench coat, and which still lacks real credibility in leather goods and top-end runway fashion.

Burberry's campaigns have mixed contemporary Britishness with fashion-forward design.

Burberry plans to increase the focus on timeless design in its campaigns.

Burberry also chose to grant Lee broad authority over the brand’s marketing and communications when he was brought on as “chief creative officer”

(a holdover in the company’s structure from the days when Christopher Bailey was simultaneously piloting design, marketing and business).

Fashion campaigns celebrated a more niche, contemporary view of Britishness that has boosted the brand’s cool-factor. But a company at Burberry’s scale needs to balance that fashion message with a simpler, easier-to-recognise take on British heritage to generate sufficient sales volume.

52-year-old Schulman served as president of Tapestry’s flagship Coach brand from 2017 to 2020, where he reduced its over-reliance on struggling US department stores and undifferentiated monogram bags, as well as pulling back on rampant discounting. He also helped support the continued rollout of creative director Stuart Vevers’ more expressive, contemporary Americana vision, elevating the brand while keeping prices and merchandising in an accessible range.

In 2021, Schulman took over as CEO of Michael Kors and was lined up to succeed John Idol as the leader of parent company Capri, but exited after Idol decided to stay in his role.

“Josh is a proven leader with an outstanding record of building global luxury brands and driving profitable growth,” Murphy said.

“Burberry is an extraordinary luxury brand, quintessentially British, equal parts heritage and innovation,” Schulman said in a statement. “Its original purpose to protect people from the weather is more relevant than ever. I look forward to working alongside Daniel Lee and the talented teams to drive global growth, delight our customers, and write the next chapter of the Burberry story.”

Former Coach chief Joshua Schulman is joining Burberry as CEO, effective immediately. (Burberry)

Falling sales and higher discounting suggest that moving further upmarket — eventually becoming a British answer to Louis Vuitton — may not be realistic. “Rather than sticking with a strategy that’s not working, could becoming a “British Coach” be the cure Burberry is looking for?” Bernstein analyst Luca Solca asked in a column last week.

Burberry says it will stick to its long-term programme of brand elevation. “Jonathan [Akeroyd] has set out a clear strategy for growth that we will build on,” Murphy said. But the move to hire a new chief executive who is strongly associated with accessible luxury sends a clear signal that the brand’s upmarket push is under review. The company said it will focus on “rebalancing our product offer to include a broader everyday luxury offer and a more complete assortment across key categories.”

The brand also said it would rebalance its communications, pulling back from its current design-forward messaging. The company is “refining our brand communication to emphasise more of the timeless, classic attributes that Burberry is known for. Our refocused marketing plans include a dedicated outerwear campaign to be launched globally in October, building on the established resilience of our house icons,” Burberry said.

“Burberry’s issues include having raised prices strongly against a weaker industry backdrop and rather weak brand momentum. The new hire, Joshua Schulman, joining from Coach and Michael Kors, may pivot Burberry towards a more affordable direction, which some market participants have been calling for,” Morningstar analyst Jelena Sokolova said.

Other analysts urged caution. “With the company’s strategy unlikely to change dramatically, the change in CEO will be very much about execution. Successful implementation of brand turnarounds seems to have become more complex in an increasingly competitive luxury market, where scale, top design talent and marketing firepower matter,” Citi analyst Thomas Chauvet said.

Some investors may also be betting that Schulman will dress Burberry up for a sale (possibly to his former employers like Tapestry or Capri). With shares down by 63 percent over the past 12 months, the brand is a more attractive target.

Next week, first-half results at LVMH and Hermès will show how well the luxury sector’s strongest groups are holding up in the current climate.

Kering’s Gucci, whose sales fell sharply at the start of the year, is another one to watch: the company is expected to insist that its new team appointed last year needs more time to turn things around. But pressure to make big changes could mount if Q2 sales show further deterioration.

BoF PROFESSIONAL

Burberry’s CEO Shake-Up, Explained

The British trench coat maker’s revenues tumbled over 20 percent this spring. How will new leadership change the strategy? And will it work?On Monday, Burberry named a new CEO — Joshua Schulman, the former leader of Coach, then Michael Kors — after comparable retail sales tumbled 21 percent in its first fiscal quarter.

The British luxury brand’s latest attempt to push upmarket under chief executive Jonathan Akeroyd and creative director Daniel Lee has struggled to gain traction in a slowing, polarised luxury market, prompting chairman Gerry Murphy to bring in new leadership.

While investors responded favourably to the move, it’s unclear how radically or how quickly a new CEO will reignite excitement in the Burberry brand after years of turnaround attempts.

An initial call with Murphy suggested the company will stick with its long-term brand elevation strategy — and current designer — while at the same time taking “decisive action” to rebalance its marketing and products to include more accessible propositions.

BoF breaks down what the shake-up means for Britain’s biggest fashion brand, and the luxury industry at large.

How badly is Burberry’s business doing?

Under its last two CEOs — Marco Gobbetti, then Akeroyd — the brand made progress on its elevation strategy, reducing its exposure to underperforming malls and wholesalers, and redirecting customers to an increasingly luxurious network of retail stores.But for more than a decade, Burberry’s top-line revenues have been broadly stagnant, despite surging demand for luxury fashion, at first among Chinese Millennials from 2016 to 2019, and then as sales in the US and Europe boomed in the aftermath of 2020′s coronavirus pandemic.

2023 revenue of £2.97 billion ($3.86 billion) was flat year-on-year. But in the past two quarters, Burberry has gone from stagnation to steep decline. Comparable retail sales fell 21 percent year-on-year in the quarter ending June 29, following a 12 percent decline at the start of the year.

“The weakness we highlighted coming into [fiscal year] 2025 has deepened and if the current trend persists through our Q2, we expect to report an operating loss for our first half,” chairman Gerry Murphy said. “In light of current trading, we have decided to suspend dividend payments.”

What went wrong under Jonathan Akeroyd?

When Jonathan Akeroyd joined Burberry in 2021 after highly successful stints at Alexander McQueen and Versace, the executive seemed like a perfect fit for the British brand: Akeroyd is known as a seasoned merchant with a knack for mixing luxurious brand positioning with it deft merchandising across categories and price points. At Versace, Donatella Versace’s glitzy runway vision drove communications while the brand moved into more upscale stores on luxury shopping streets — but continued to sell iconic silk shirts and small handbags for under $1,000 (not to mention entry-price options like $75 boxer shorts and $300 pool slides).But Akeroyd’s strategy for the company was being implemented at the same time as a post-pandemic luxury wound down, and the company made a few key missteps during the transition from former designer Riccardo Tisci’s bold-faced, streetwear-inflected vision to the first collections by current creative director Daniel Lee.

Burberry’s first collection under Lee appeared to give free reign to the designer’s sensual, textural, pop take on British luxury, helping to quickly update the brand’s image. But Lee’s offering came with eye-popping price tags that alienated aspirational customers.

New ranges of supple leather bags like Shield and Knight were priced at nearly $3,000, limiting their audience, while cool show pieces like duck- and fox-shaped beanies came in at $4,500. Chunky block-heeled loafers or Timberland-inspired nubuck “Trek boots” failed to take off when priced above $1,000, and have since been marked down over 50 percent by Saks and Neiman Marcus.

Burberry has since worked to fill in its offer with more accessible propositions, but many items are still priced too highly to attract a new cohort of clients at a brand whose starting point is the trench coat, and which still lacks real credibility in leather goods and top-end runway fashion.

Burberry's campaigns have mixed contemporary Britishness with fashion-forward design.

Burberry plans to increase the focus on timeless design in its campaigns.

Burberry also chose to grant Lee broad authority over the brand’s marketing and communications when he was brought on as “chief creative officer”

(a holdover in the company’s structure from the days when Christopher Bailey was simultaneously piloting design, marketing and business).

Fashion campaigns celebrated a more niche, contemporary view of Britishness that has boosted the brand’s cool-factor. But a company at Burberry’s scale needs to balance that fashion message with a simpler, easier-to-recognise take on British heritage to generate sufficient sales volume.

Who is Burberry’s new CEO?

Murphy has pledged “decisive action” to get the company back on track, including bringing on a new CEO, Joshua Schulman, with immediate effect.52-year-old Schulman served as president of Tapestry’s flagship Coach brand from 2017 to 2020, where he reduced its over-reliance on struggling US department stores and undifferentiated monogram bags, as well as pulling back on rampant discounting. He also helped support the continued rollout of creative director Stuart Vevers’ more expressive, contemporary Americana vision, elevating the brand while keeping prices and merchandising in an accessible range.

In 2021, Schulman took over as CEO of Michael Kors and was lined up to succeed John Idol as the leader of parent company Capri, but exited after Idol decided to stay in his role.

“Josh is a proven leader with an outstanding record of building global luxury brands and driving profitable growth,” Murphy said.

“Burberry is an extraordinary luxury brand, quintessentially British, equal parts heritage and innovation,” Schulman said in a statement. “Its original purpose to protect people from the weather is more relevant than ever. I look forward to working alongside Daniel Lee and the talented teams to drive global growth, delight our customers, and write the next chapter of the Burberry story.”

Former Coach chief Joshua Schulman is joining Burberry as CEO, effective immediately. (Burberry)

Will Burberry change its strategy?

Amid rising costs for quality manufacturing, as well as increased income inequality that has fuelled polarisation in the fashion market, the logic behind Burberry’s long-standing mission to play at the top end of the market remains intact — to an extent.Falling sales and higher discounting suggest that moving further upmarket — eventually becoming a British answer to Louis Vuitton — may not be realistic. “Rather than sticking with a strategy that’s not working, could becoming a “British Coach” be the cure Burberry is looking for?” Bernstein analyst Luca Solca asked in a column last week.

Burberry says it will stick to its long-term programme of brand elevation. “Jonathan [Akeroyd] has set out a clear strategy for growth that we will build on,” Murphy said. But the move to hire a new chief executive who is strongly associated with accessible luxury sends a clear signal that the brand’s upmarket push is under review. The company said it will focus on “rebalancing our product offer to include a broader everyday luxury offer and a more complete assortment across key categories.”

The brand also said it would rebalance its communications, pulling back from its current design-forward messaging. The company is “refining our brand communication to emphasise more of the timeless, classic attributes that Burberry is known for. Our refocused marketing plans include a dedicated outerwear campaign to be launched globally in October, building on the established resilience of our house icons,” Burberry said.

How did markets respond?

Shares in Burberry rose 2 percent following the CEO shake up, even as quarterly sales missed estimates by 6 percent and the company suspended its dividend. Many analysts welcomed the leadership shake up amid poor results, and were hopeful that terms like “everyday luxury” and “inclusive products” suggest that more affordable propositions are on the way.“Burberry’s issues include having raised prices strongly against a weaker industry backdrop and rather weak brand momentum. The new hire, Joshua Schulman, joining from Coach and Michael Kors, may pivot Burberry towards a more affordable direction, which some market participants have been calling for,” Morningstar analyst Jelena Sokolova said.

Other analysts urged caution. “With the company’s strategy unlikely to change dramatically, the change in CEO will be very much about execution. Successful implementation of brand turnarounds seems to have become more complex in an increasingly competitive luxury market, where scale, top design talent and marketing firepower matter,” Citi analyst Thomas Chauvet said.

Some investors may also be betting that Schulman will dress Burberry up for a sale (possibly to his former employers like Tapestry or Capri). With shares down by 63 percent over the past 12 months, the brand is a more attractive target.

Will other brands follow Burberry’s lead?

Shake ups to senior management, pricing and communication could be on the horizon at other firms. Burberry is certainly not the only brand struggling to navigate a slowing luxury market.Next week, first-half results at LVMH and Hermès will show how well the luxury sector’s strongest groups are holding up in the current climate.

Kering’s Gucci, whose sales fell sharply at the start of the year, is another one to watch: the company is expected to insist that its new team appointed last year needs more time to turn things around. But pressure to make big changes could mount if Q2 sales show further deterioration.

Last edited:

LadyJunon

Well-Known Member

- Joined

- Aug 17, 2020

- Messages

- 4,986

- Reaction score

- 11,841

WWD on the new Burberry strategy:

Summary on Schulman's strategy:

• Burberry will be repositioned to become a more "inclusive, democratic" brand.

• This will be done by broadening the product range to include more accessibly priced products that appeal to a wider clientele.

• The brand will bring in a wider range of products centering on timeless, classic, heritage-based aesthetics like outerwear.

• That said, the brand will retain a few higher priced halo products that center “innovation, design, and quality".

• The brand will also work on improving online experiences.

WWDBurberry Shakeup: Joshua Schulman Replaces Jonathan Akeroyd at Burberry Helm as Retail Sales Plummet 22% in Q1

Burberry is taking drastic action amid a slowdown in sales in the first quarter, and the risk of an operating loss in the first six months.

By SAMANTHA CONTI

JULY 15, 2024, 3:59PM

LONDON — Joshua Schulman has been named chief executive officer of Burberry in stormy weather, amid a 22 percent decline in first-quarter retail revenue and the risk of an operating loss in the first fiscal half.

Schulman, 52, will succeed Jonathan Akeroyd, who was ousted two years into his tenure during one of the most brutal macroeconomic periods the luxury goods industry has witnessed in more than a decade.

An accomplished retailer and brand builder, Schulman will take up his job on Wednesday following the surprise announcement by Burberry on Monday morning before markets opened.

The first-quarter trading statement was issued at the same time as Schulman’s CEO announcement, reflecting the drastic action that Burberry has been forced to take amid the ongoing slowdown in luxury spending; a Chinese cohort that’s in no mood to spend, and the brand’s own troublesome move upmarket at a time of slow growth and high interest rates.

The trading update and CEO switch sent Burberry’s shares plummeting, and they closed down 17 percent at 7.35 pounds on the London Stock Exchange.

Chairman Gerry Murphy called the quarter “disappointing,” and said that if the weakness in luxury demand persists through the second quarter, Burberry will report an operating loss for the first half.

He also suspended dividend payments for the current fiscal year, which should make for a lively AGM on Tuesday in London.

Retail revenue was down 22 percent to 458 million pounds. At constant exchange rates it fell 20 percent. Comparable store sales sank 21 percent in the three months to June 29, compared with an 18 percent increase in the corresponding period last year.

Murphy and Burberry’s board of directors, who welcomed Akeroyd just two years ago, are now pinning their hopes on Schulman, whom they believe can transform Burberry into a brand with broader appeal and a tighter focus on luxury outerwear and soft accessories.

“Josh is a proven leader with an outstanding record of building global luxury brands and driving profitable growth. He has a strong understanding of our brand and shares our ambition to build on Burberry’s unique creative heritage. His extensive experience in luxury and fashion will be key to realizing Burberry’s full potential,” said Murphy.

Schulman to the Rescue

Murphy said the board “didn’t conduct any serious discussions with anybody about replacing Jonathan until very recently,” and then it acted quickly.

“Josh was known to a lot of us at the company, and we’d [originally] been talking to him about a board role,” said Murphy. “As things evolved, it was clear that he was interested in a bigger role and we acted.”

Schulman, who will lead the executive committee and report to Murphy and the board of directors, said he is “deeply honored to join Burberry as CEO. Burberry is an extraordinary luxury brand, quintessentially British, equal parts heritage and innovation. Its original purpose to protect people from the weather is more relevant than ever.”

The executive said he’s looking forward to working alongside Burberry’s creative director Daniel Lee and the teams “to drive global growth, delight our customers, and write the next chapter of the Burberry story.”

Murphy stressed that Lee will remain at the company. “He is not going anywhere. He is looking forward to working with Josh. They’ve already spoken and will meet later this week. There is no change in terms of creative leadership,” he said.

Schulman is a well-rounded retail leader known for building brands and restoring them to health. His appointment as CEO marks his return to the industry after two years, following his exit from Capri Holdings. He is returning to the U.K., 12 years after leaving Jimmy Choo.

Most recently, Schulman was head of the Michael Kors brand at Capri Holdings and was set to become Capri’s CEO, succeeding John Idol.

But then, in a surprise move, Idol stayed on and Schulman exited with a multimillion-dollar separation agreement.

Before joining Capri, Schulman served as CEO of Coach. Prior to his arrival, the brand had been struggling and revenues had been shrinking for several years. Schulman restored it to quality growth and made market share gains, moves that won him plaudits in the financial community.

Luxury executives have described him as strategic, organized, methodical, and focused on execution.

He’s also a lateral thinker. During his pre-Coach days as president of Bergdorf Goodman, Schulman brought in some unexpected labels such as Vetements, Off-White and Fenty by Puma while maintaining the store’s luxury offer, which included Chanel, Valentino and Goyard.

During his five years as CEO of Jimmy Choo, he transformed the business from a niche player into a multimillion-dollar global luxury brand, doubling the store count, entering new categories, and taking control of the Japanese and Hong Kong businesses before selling it to Labelux in 2011 for 500 million pounds.

At Burberry, Schulman’s salary will be 1.2 million pounds a year, and he will be eligible for a target bonus of 100 percent of salary, and a maximum of 200 percent of salary, and a Burberry share plan award of 162.5 percent of salary.

Burberry Won’t Be a ‘British Coach’

Murphy said that under Schulman, Burberry would take “decisive action” to rebalance the offer. It will become “more familiar to Burberry’s core customers while delivering relevant newness,” but under no circumstances will it be transformed into a version of Coach, or lose its luxury positioning, he said repeatedly.

Burberry’s intention is to bring in a “broader, everyday luxury” offer and a more complete assortment across key categories. Going forward, the focus will be on “timeless, classic attributes that Burberry is known for,” Murphy added.

The brand has also vowed to improve customer conversion online with a more edited assortment and better functionality.

“Josh’s background is actually much closer to luxury than anything else, and he’s got a very clear view that Burberry is a true luxury brand and has a spectacular potential in what Jonathan [Akeroyd] coined as ‘modern British luxury.’

“There is no intention of changing that ambition, or of becoming a British Coach. That is not to disparage Coach in any way — it’s just a different business,” Murphy said, adding that Burberry also had zero ambition to become a “British Louis Vuitton.”

Murphy added that Burberry made the leadership change due to a number of factors.

“Our strategy has been quite coherent for a while. But with the benefit of hindsight, in a weak market, we perhaps went a bit too far too fast with a creative transition at a time when customers are feeling a bit more challenged, and a bit more conservative in sampling newness, especially at higher price points,” he said.

He stressed that while Burberry plans to focus on more recognizable, classic items and outerwear, the brand was not changing tack or becoming more mass.

“It’s not about dropping prices. It’s about making sure that we have a product that people want at prices that are acceptable from Burberry,” Murphy said, adding there will be some high price points going forward for merchandise that has “more innovation, design content, and higher-cost materials.

“This is about having a more inclusive and democratic brand, and not about a reversal of strategies. It’s about us rebalancing to ensure that people can get what they want from Burberry,” he added.

Not everyone is convinced.

Bernstein’s Luca Solca wrote that Schulman’s appointment “speaks volumes about how the brand repositioning will work — downward from the recent, relatively abrupt attempt to move the brand

upmarket. Brand power is already damaged by the fact that following the failure of moving up, Burberry has been discounting very heavily.”

By contrast, Neil Saunders, managing director of GlobalData, believes that Schulman will be able to walk the very fine line between luxury and democracy.

He called Schulman’s appointment “interesting” and said the executive “has an extremely firm grip on market realities and an intimate understanding of the luxury space. He also has experience in repositioning brands — such as Coach where, despite some painful moments, he delivered a successful turnaround.

“For the most part, Schulman’s playbook has been about accessible luxury: that fine middle-ground of avoiding ubiquity and cheapness while still allowing a broad base of consumers to buy into a brand. This is a strategy he is likely to use at Burberry and it marks a welcome step change from the unrealistic push to a more rarified and uber-luxury brand position,” Saunders said.

A Tough Start to the Year

In the first quarter, Burberry saw comparable sales decline across all the key regions. Asia Pacific and the Americas were both down by 23 percent, while the Europe, Middle East, India and Africa region fell by 16 percent.

Mainland China was down by 21 percent; South Asia Pacific by 38 percent, and South Korea by 26 percent. Japan was the only Asian country growing, up 6 percent in the period.

The company said that by product, outerwear and scarves continued to perform globally. As reported earlier this year, ready-to-wear sales have underperformed.

In the meantime, Burberry will continue to pursue efficiencies as it seeks to drive up sales. And there are no plans to stop discounting — at least not yet.

Burberry chief financial officer Kate Ferry said that discounting would continue to be part of the strategy. “Outlets are a really important part of our product lifecycle, particularly when it comes to the clearance of end-of-season product. They play an important role, although over time we expect to reduce our exposure to the channel,” she said.

She also confirmed British press reports of imminent layoffs.

She said the company is taking a hard look at its cost base and operational delivery and, as a result, “a few hundred roles globally” would be eliminated, most of them corporate jobs in the U.K. Ferry added that the company is currently in a consultation process with affected staff.

Ferry addressed Burberry’s decision to suspend dividends and emphasized that there were “no liquidity concerns” at the company, which has around a billion pounds at its disposal.

“Clearly we are taking a prudent approach to the dividend until profitability improves and trading picks up,” she said, adding that the decision to withhold dividends “is really about enabling us to invest in the business” until top-line growth returns.

Difficulties Remain

Murphy said Burberry has faced a number of headwinds in its attempts to move upmarket.

“We moved quickly with our creative transition in a luxury market that is proving more challenging than we expected. The weakness of the U.S. market; the deteriorating consumer confidence in mainland China; stability in Europe; as well as the U.K.’s [demise] as a shopping destination have all the headwinds in our creative transition,” he said.

Like many other luxury leaders, Murphy has been outspoken in his criticism of the previous U.K. government, which canceled tax-free shopping for foreigners following Brexit. Sources have said it’s unlikely that the new Labour government will reinstate the tax perk for big-spending shoppers.

He said the share price, which has fallen nearly 60 percent over the past year and 30 percent in the past six months alone, is responding to weak current trading.

“We acknowledge our results are disappointing, but we’ve got all the plans in place to improve that and we don’t think the share price today reflects the underlying value of business in any way,” Murphy said.

Things Can Only Get Better

Murphy said that all of Burberry’s moves, including cost savings, should “start to deliver an improvement in our second half, and to strengthen our competitive position and underpin long-term growth.”

He was also upbeat about the company’s short- and medium-term prospects, and said that once Burberry tweaks its strategy and the macro-economic backdrop improves, especially in China, the company should be well on its way to recovery.

“We expect to see an improvement in trading in the second half,” said Murphy, adding that while China may be “showing relative weakness,” now the fundamentals in the medium term are very good.

“Once we see more stability in the macro environment, the stock market and the real estate environment, we expect a stabilization of demand and recovery in China, not least in mainland China, but also across from the Chinese community as they reengage with global travel following the pandemic,” he said.

Farewell to Jonathan Akeroyd

Schulman’s appointment closes a very short chapter for Akeroyd, who joined Burberry in 2022 from Versace, which belongs to Capri Holdings. Prior to joining Versace, Akeroyd served as CEO of Alexander McQueen after having begun his career at Harrods.

Less than two years ago, Akeroyd set out his plan to move Burberry further upmarket to compete with brands such as Dior, Louis Vuitton and Gucci.

He projected revenue growth of 4 billion pounds in the medium term, and 5 billion pounds in the long term, at constant exchange rates, and with “good” margin progression.

His new vision included “a refocus on Britishness,” doubling the sales of leather goods, shoes and women’s ready to wear, and growing outerwear by 50 percent in the medium term.

Another of Akeroyd’s ambitions was to grow accessories to more than 50 percent of group sales in the medium term.

Those plans came with hefty price tags: 2,000 pounds for the medium Rocking Horse shoulder bag; 2,000 pounds for a Long Gabardine Trench Coat, and 690 pounds for a pair of Check Knit Box sneakers.

While those prices may seem normal in the luxury goods business, they have been shocking to many longtime British customers and non-fashion institutional investors, who view Burberry as a heritage brand that should be growing through sales of accessibly priced, classic merchandise.

Akeroyd was also counting on Lee — whose bags and accessories were a runaway success at Bottega Veneta — to deliver a string of bestsellers, but they have yet to materialize.

Akeroyd’s strategy might have been successful at another point in time, but with China (historically, one of Burberry’s biggest markets) still cautious about spending, and U.S. demand tepid, his plan only dented the share price and stymied sales.

On Monday, Murphy thanked Akeroyd for the contribution he made to the company. “Jonathan has set out a clear strategy for growth that we will build on,” he said.

Akeroyd will not be eligible for a bonus for the current financial year, and all unvested share awards will lapse in full.

It will now be up to Schulman, Burberry’s fourth CEO in seven years, to reposition the brand for profitable growth, unfreeze the dividend payments, and restore the brand to its former glory as a top purveyor of outerwear.

Summary on Schulman's strategy:

• Burberry will be repositioned to become a more "inclusive, democratic" brand.

• This will be done by broadening the product range to include more accessibly priced products that appeal to a wider clientele.

• The brand will bring in a wider range of products centering on timeless, classic, heritage-based aesthetics like outerwear.

• That said, the brand will retain a few higher priced halo products that center “innovation, design, and quality".

• The brand will also work on improving online experiences.

visvim2001

Well-Known Member

- Joined

- May 3, 2024

- Messages

- 85

- Reaction score

- 275

Tbh I’m not sure that their problems were entirely of the executive team’s own making…Lee is a very underwhelming designer, a perfect poster boy for Gen Z mediocrity. Such a rich heritage, and yet he puts out what I can only describe as ‘gay chav on acid’ lookbooks. Wavy checks, pants in strange colours that pool at the ankles, extremely deep v-necks, psychedelic rose prints, bulging sneakers. p*rnstar nova lingerie for the ladies. What the hell? Is this what people from Essex wear? I don’t know who else would pay 5k for this sh*t.

I miss Burberry black label, by the way. Big fan. The Japanese team did a fantastic job reinterpreting sharp British lines to fit their Asian clientele. Very mod, very dapper. Too bad Sanyo lost the licence.

I miss Burberry black label, by the way. Big fan. The Japanese team did a fantastic job reinterpreting sharp British lines to fit their Asian clientele. Very mod, very dapper. Too bad Sanyo lost the licence.

style_expert

Well-Known Member

- Joined

- Jan 6, 2006

- Messages

- 8,921

- Reaction score

- 1,650

I have to say I'm pretty content with the fact that Jonathan Akeroyd was let go of before Daniel Lee.

It's a tough lesson for Jonathan that in the end the consumers will always decide. No matter how susceptible they are to marketing and hype, they're often not complete idiots when it comes to pricing and perceived (brand) value.

With Daniel Lee and his designs they already have the ideal creative output to turn Burberry into a cooler, British version of Coach. All they need to do is reduce their current pricing by about 75% and it can be a hit indeed. At a more accessible price point it will speak to a different client.

Greediness will surely prevent them from doing so but best of luck to the new CEO....

It's a tough lesson for Jonathan that in the end the consumers will always decide. No matter how susceptible they are to marketing and hype, they're often not complete idiots when it comes to pricing and perceived (brand) value.

With Daniel Lee and his designs they already have the ideal creative output to turn Burberry into a cooler, British version of Coach. All they need to do is reduce their current pricing by about 75% and it can be a hit indeed. At a more accessible price point it will speak to a different client.

Greediness will surely prevent them from doing so but best of luck to the new CEO....

Oh, great.WWD on the new Burberry strategy:

WWD

Summary on Schulman's strategy:

• Burberry will be repositioned to become a more "inclusive, democratic" brand.

I am so sick of those words. Just be honest and tell us you are moving forward with a strategy of making basic trash for everyone.

PDFSD

Well-Known Member

- Joined

- Mar 27, 2024

- Messages

- 2,388

- Reaction score

- 8,462

Desire is in this case is not tempered by the high price....because simply there has not been yet !!! a show or ad campaign or one product!!! that was designed by Lee and his team that has clicked with fashion lovers or a wider audience ......end of this story /chapter.

...its one sided onliner to say reduce price reduce price i see everywhere written ...funny how nobody writes how in love they are with it or what pieces are in the top 10 dream shopping list of items to get this season or year etc etc its cost nothing to dream or desire!

Lee just did not do the right creative direction yet that resonates with any audience !!! that's his responsibility not the CEO or anyone else.

...its one sided onliner to say reduce price reduce price i see everywhere written ...funny how nobody writes how in love they are with it or what pieces are in the top 10 dream shopping list of items to get this season or year etc etc its cost nothing to dream or desire!

Lee just did not do the right creative direction yet that resonates with any audience !!! that's his responsibility not the CEO or anyone else.

Oh, great.

I am so sick of those words. Just be honest and tell us you are moving forward with a strategy of making basic trash for everyone.

Menâs Designer T-Shirts | BurberryÂ®ï¸ Official

Designer T-shirts and polo shirts for men including Burberry Check styles.

Already there, they just need to sell them for not-$500

You can find these shirts at their outlet stores for like $149, which is still ridiculous for a tshirt.

Menâs Designer T-Shirts | BurberryÂ®ï¸ Official

Designer T-shirts and polo shirts for men including Burberry Check styles.us.burberry.com

Already there, they just need to sell them for not-$500

Their game is not about saving face. Ever. Their game is “make more money, NOW”. LolTo be honest, I wouldn't be suprised if Burberry renews Lee's contract to solely save face. Also, it would be insanely difficult to replace him unless they aim for under-35s. Most industry veterans wouldn't join a struggling down-market Burberry, unless they were given Hedi-style creative reign across the brand.

Frederic01

Well-Known Member

- Joined

- Jun 7, 2021

- Messages

- 1,914

- Reaction score

- 4,742

style_expert

Well-Known Member

- Joined

- Jan 6, 2006

- Messages

- 8,921

- Reaction score

- 1,650

Bizarre honestly...all I can say is I'm glad I don't own any Burberry stocks.

Burberry group is down 65% since last year and at the absolute lowest point in the past 5 years.

It's almost like they're begging to be taken over by a rival.

Burberry group is down 65% since last year and at the absolute lowest point in the past 5 years.

It's almost like they're begging to be taken over by a rival.

Lola701

Well-Known Member

- Joined

- Oct 27, 2014

- Messages

- 13,746

- Reaction score

- 36,422

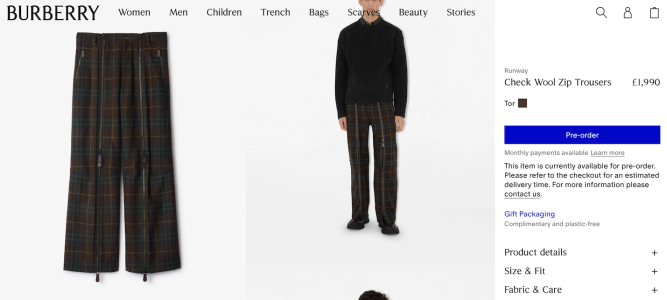

At this point they are sabotaging this man’s work. I wouldn’t be surprised to learn that he is totally isolated from the merchandise team, obviously on the brand website, all the good stuff is obviously by Lee and all the classic check ugly boring stuff is by another team. And it seems like the offering of Lee’s work is less important than the classic check stuff.The prices for the Autumn Winter 2024 collection are crazy! I see they won't budge on the pricing / "brand elevation" strategy. Strange. I thought they had acknowledged that strategy wasn't working?

View attachment 1298983

BURBERRY

Maybe they should give the CD to AI

Similar Threads

- Replies

- 1K

- Views

- 136K

- Replies

- 2

- Views

- 3K

- Replies

- 980

- Views

- 140K

- Replies

- 28

- Views

- 5K

- Replies

- 80

- Views

- 16K

Users who are viewing this thread

Total: 1 (members: 0, guests: 1)