-

Live Streaming... The S/S 2026 Fashion Shows

Paris Fashion Week S/S 2026 Show Schedule

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Daniel Lee - Designer, Creative Director of Burberry

- Thread starter dodencebt

- Start date

LadyJunon

Well-Known Member

- Joined

- Aug 17, 2020

- Messages

- 4,915

- Reaction score

- 11,582

Seems like they're sticking with Lee:

WWDDaniel Lee Is Staying Put as CEO Josh Schulman Positions Burberry for Growth

By Samantha Conti

May 14, 2025, 4:27pm

LONDON — Times are getting tougher, but Burberry is rising to the challenge with a new cost-savings plan that could see 20 percent of its workforce eliminated by 2027, and a determination to build sales back to 3 billion pounds, with designer Daniel Lee fully committed.

Chief executive officer Josh Schulman, who arrived last summer, has been acting swiftly to stabilize the business, where revenue fell 17 percent to 2.46 billion pounds in fiscal 2025.

In the 12 months to March 29, comparable retail sales slid 12 percent, but the trend has been improving. In the second half, those same-store sales fell just 5 percent, compared with 20 percent in the first half.

The decline in revenue led to an operating loss of 3 million pounds compared with a profit of 418 million pounds in the previous year.

Adjusted operating profit was 26 million pounds, compared with 418 million pounds in the previous year. Once again the trend was an upward one, with Burberry notching a profit of 67 million pounds in the second half, which offset a loss of 41 million pounds in the first six months.

Inventory fell faster than expected during the year, outstripping analysts’ projections. Schulman said the company can now move forward to a new era of product “scarcity” — and desirability.

Schulman knew he was on the right track with the scarcity strategy a few weeks ago when he tried to buy a B Clip bag — one of Burberry’s current bestsellers — for Mother’s Day. There wasn’t one to be found in North America, and he ended up sending one from Europe to his mother in Los Angeles.

Schulman has been going farther — and faster — with his “Burberry Forward” plan that’s aimed at rebuilding sales, margins and cashflow. He’s putting the focus on “art and science,” tightening operations and laying off staff.

This week, in conjunction with the 2025 results, Burberry unveiled an enriched cost-savings plan aimed at unlocking a total of 100 million pounds by fiscal 2027.

Last year, the company had already revealed a plan to save 40 million pounds in the same time span. It has targeted a further 60 million pounds in cost savings, with plans to eliminate some 1,700 global roles and use its funds to invest in future growth opportunities.

“Today has been a tough day,” Schulman said in an interview from his office in Burberry’s newly refurbished Horseferry House headquarters in Westminster.

“There are lots of mixed emotions because, on the one hand, we’re seeing the progress of Burberry Forward, and my optimism has moved to confidence that it is the right path for us. On the other hand, we’re entering into a process where we may say goodbye to many colleagues who have contributed to the Burberry Forward turnaround,” he added.

The markets applauded the strategy, sending Burberry shares soaring nearly 16 percent to close at 9.57 pounds on Wednesday.

Burberry plans to cut mainly office-based jobs, and also wants to reorganize the schedules of its shop floor staff so they are working during “peak traffic hours,” Schulman said.

One staff member who’s staying put is Lee, Burberry’s chief creative officer, who over the past year has been keeping the industry guessing about his future moves.

“Daniel and I are committed together to moving Burberry forward,” Schulman told WWD. He added that the designer, who joined Burberry in 2022, has been delivering “an extraordinary expression of timeless British luxury.”

In another cost-cutting measure, Burberry will also eliminate the night shift at its factory in Castleford, Yorkshire, where the gabardine trenchcoats are made. Around 25 percent of staff will be impacted.

Burberry said the downsizing is due to overproduction. Like many other British businesses, Burberry has been hit hard by the Labour government’s raft of new taxes on employers, resulting in job cuts across a variety of industries.

Schulman said he’s proud of Burberry’s manufacturing heritage in the U.K. and is cutting staff to “safeguard the long-term viability” of local operations.

The company is planning a “multimillion-pound” investment in Castleford in the second half of the year. Schulman said he wants to see that factory, and Burberry’s other Yorkshire site that makes the gabardine fabric, thrive “for many generations to come.”

He’s running a tight ship. Shortly after arriving at Burberry last year, Schulman chose not to replace the company’s chief commercial officer. Instead, he’s doing the job himself, with the major regional heads reporting directly to him.

The most recent person in the role was Gianluca Flore, who left shortly before Schulman joined the company.

Schulman thought the role would only be temporary, but “as I got to know the organization, I thought there was an opportunity for all of us to get closer to the customer. So I decided a few months ago that I would not replace the chief commercial officer and, in essence, that takes the CEO one step closer to the customer,” he said.

He’s also putting a big focus on teamwork.

Schulman said that he, Lee, Burberry’s chief marketing officer Jonathan Kiman and Paul Price, chief product merchandising and planning officer, all worked together on Burberry’s fall 2025 show from “end to end.”

Burberry’s star-studded campaigns, which tap into British culture, film and humor, are also the result of that collective effort, he said.

Schulman and his team have also been laser-focused on the product, and promoting it to a wide variety of customers.

At Horseferry House, there are Burberry-clad mannequins everywhere.

Instead of digital screens beaming out shows, the lobby is filled with them dressed in Lee’s latest designs. Schulman even challenged the equities analysts to check out the mannequins in the room where he was presenting the 2025 results.

“Later, we can have a game. See if you can tell me which are the runway looks and which are the commercial ones,” said Schulman, adding that both should be indistinguishable and “live holistically together.”

In that same room there was also a scarf bar on display. Schulman said the rollout had begun and there should be nearly 200 scarf bars worldwide by the end of this year. The company will be offering a scarf personalization service in a bid to drive sales volumes on the shop floor.

Asked about the new U.S. tariff regime, Schulman argued that Burberry was “less exposed” than some of its peers as the region represents 19 percent of sales. Tariffs on U.K. goods landing in the U.S. are currently at 10 percent.

Schulman described the tariff situation as “dynamic and changing. We’re as prepared as we can be.” He said Burberry had already been working on its price architecture, and has already made some “surgical” midsingle-digit price increases. Going forward, he said Burberry planned to “protect” its opening price points in the face of tariffs.

He noted that Burberry was much more exposed in Asia-Pacific, which represents around one-third of revenue.

Asia-Pacific was the worst performer in fiscal 2025, with comparable store sales falling 16 percent. Mainland China was down 15 percent, while sales in South Korea fell 18 percent.

The Americas registered a 9 percent drop while the EMEIA region, Europe, the Middle East, India and Africa, saw sales decline 8 percent.

Burberry has had a “choppy” start to the new year, which began on March 30, shortly before U.S. President Donald Trump unveiled his draconian tariff regime, which he later amended.

Analysts were broadly upbeat about Schulman’s creative and business moves so far.

RBC Capital Markets said Burberry’s fourth-quarter performance was better than expected, and gave a thumbs up to the deeper cost-saving program.

“We view these results as an encouraging first step, and believe management are pursuing the right strategy to reset the business on a more level footing, which in time should support a return to positive revenue and profit growth,” the bank said.

Deutsche Bank said Burberry “is showing further progress on its brand turnaround” with the fourth quarter “sequentially better than Burberry’s luxury peers. We like the Burberry story and see the sequential improvement in sales as the key factor for investors over the next 12 months.”

Citi maintained its buy rating on the stock, and said Burberry “has fared better than its peers through this reporting season. We appreciate cost agility in a more uncertain macroeconomic environment and the announcement” of the updated cost-savings program, of which 24 million pounds has already been delivered.

The bank called Burberry Forward a “sensible” plan and believes it will “reignite brand visibility and desirability. Burberry’s strategic plan is robust, we think. While patience is needed, potential rewards now outweigh the risks,” Citi said.

jeanclaude

Well-Known Member

- Joined

- Feb 12, 2012

- Messages

- 4,548

- Reaction score

- 13,070

It was pretty obvious this was gonna happen. And it will be worse as time goes by.

vetements

Well-Known Member

- Joined

- May 29, 2007

- Messages

- 1,012

- Reaction score

- 415

Seems like they're sticking with Lee:

WWD

“Later, we can have a game. See if you can tell me which are the runway looks and which are the commercial ones,” said Schulman, adding that both should be indistinguishable and “live holistically together.”

mixed emotions. Does this mean Daniel`s creative juices will have to be limited?

but bravo! I am for anything, as long as Daniel gets to keep his job here. Admittedly, his work may have been a little too fashionable til the last season`s where it is way more commercial, more mass and inching closer to what traditional Burberry customers will like.

But all in all, I am quite liking this CEO from this interview, if all that is written here is true.

Seems like he is a pragmatic person, job cuts in the night shift trenchcoat factories in the UK, doing the COO job himself, being involved in the campaigns from end to end etc. and the results are showing.

Deleted member 119799

New/Inactive Member

- Joined

- Jun 28, 2009

- Messages

- 1,157

- Reaction score

- 989

How refreshing that this CEO isn’t blaming everything that went wrong on the creative director - and that they’re actually planning to stick with DL.

I thought the last show was solid. The campaigns aren’t to my taste, but I can see the appeal for customers.

I also appreciate the CEO’s mindset. Usually, you walk into a luxury store and there’s one sad rack of runway looks that feel totally out of place - and the rest is just bland, depressing commercial filler.

It’s refreshing to see a brand be upfront about what it’s about, doing that well and taking pride in that, unlike Prada, Vuitton, etc.

I thought the last show was solid. The campaigns aren’t to my taste, but I can see the appeal for customers.

I also appreciate the CEO’s mindset. Usually, you walk into a luxury store and there’s one sad rack of runway looks that feel totally out of place - and the rest is just bland, depressing commercial filler.

It’s refreshing to see a brand be upfront about what it’s about, doing that well and taking pride in that, unlike Prada, Vuitton, etc.

PDFSD

Well-Known Member

- Joined

- Mar 27, 2024

- Messages

- 2,304

- Reaction score

- 7,996

ceo is just saying what is already clear for a while he is smart enough to frame the storyline into his WIP narrative.

“Later, we can have a game. See if you can tell me which are the runway looks and which are the commercial ones,”

even when this happens a lot he should not say it , i feel still he wants to be the star his conversations toward Lee is still from a surprior standpoint and only because the reality of hiring another CD is expensive joke again and kim jones allegedly did not work out he is brave to double down on saying Lee is staying now. (he should have said it from the start very clearly it would be more believable as part of his plan)

the marketing officer is ex gucci and you can see the approach is gucci alessandro era dressed up in a Burberry check there is no holistic vision yet , hence he says it's a game of hiding the commercial between runway approach that is simplistic and is short term vision.

there is still more to be done also on Lee side with the Ceo they will have to be close and trusting of each other while challenging each other in a productive way...i don't fel this is reflected in the Ceo way of speaking ...it's still two camps under one tent ...time will tell.

i feel he is learning on the job this ceo

“Later, we can have a game. See if you can tell me which are the runway looks and which are the commercial ones,”

even when this happens a lot he should not say it , i feel still he wants to be the star his conversations toward Lee is still from a surprior standpoint and only because the reality of hiring another CD is expensive joke again and kim jones allegedly did not work out he is brave to double down on saying Lee is staying now. (he should have said it from the start very clearly it would be more believable as part of his plan)

the marketing officer is ex gucci and you can see the approach is gucci alessandro era dressed up in a Burberry check there is no holistic vision yet , hence he says it's a game of hiding the commercial between runway approach that is simplistic and is short term vision.

there is still more to be done also on Lee side with the Ceo they will have to be close and trusting of each other while challenging each other in a productive way...i don't fel this is reflected in the Ceo way of speaking ...it's still two camps under one tent ...time will tell.

i feel he is learning on the job this ceo

tourbillions

Well-Known Member

- Joined

- Dec 19, 2020

- Messages

- 2,360

- Reaction score

- 6,595

Its good for them to stick to lee... with enough time he can get a hit and i think burberry could afford it.

But if he never does make that one hit, what would they do

But if he never does make that one hit, what would they do

Lola701

Well-Known Member

- Joined

- Oct 27, 2014

- Messages

- 13,576

- Reaction score

- 35,362

Maybe it’s time to also push products down the throats of people through influencers like Dior do. They have to be subtle and strategic about it of course but at a time where brand perception is so crucial on Social Media, maybe it’s time to reframe the narrative behind owning a Burberry piece.

We don’t see the brand on Redcarpet or street-styles.

Daniel Lee seems to be friendly with some celebs and we don’t see anybody even with a bag or a trench.

We don’t see the brand on Redcarpet or street-styles.

Daniel Lee seems to be friendly with some celebs and we don’t see anybody even with a bag or a trench.

tourbillions

Well-Known Member

- Joined

- Dec 19, 2020

- Messages

- 2,360

- Reaction score

- 6,595

never thought about this.. even during tisci era, we saw them somewhere.We don’t see the brand on Redcarpet or street-styles.

Are they not pushing hard enough? even then who could afford lee's burberry at non-sales prices. i know i want some of it when they hit the discount stores.

Lola701

Well-Known Member

- Joined

- Oct 27, 2014

- Messages

- 13,576

- Reaction score

- 35,362

Maybe they are doing it in Asia but in the western world? No.never thought about this.. even during tisci era, we saw them somewhere.

Are they not pushing hard enough? even then who could afford lee's burberry at non-sales prices. i know i want some of it when they hit the discount stores.

And Burberry has that advantage that it’s a brand that can be worn by people under contracts. It’s not a direct competitor.

I’m saying something stupid but if we see within two weeks photos of Kendall Jenner and Hailey Bieber wearing Burberry trenches, it will generate conversation at least on fashion accounts on IG. It’s already something.

They did great at the MET but how does it translate to real life?

Tisci dressed some people: Kim, Carine…etc. But so far it seems like Burberry only exist through the show, stores opening and the campaigns on social media. Beautiful campaigns btw but with people that the general public or even a random fashion fan won’t recognize.

hamburgers

Well-Known Member

- Joined

- Mar 25, 2025

- Messages

- 197

- Reaction score

- 875

Are they not pushing hard enough? even then who could afford lee's burberry at non-sales prices. i know i want some of it when they hit the discount stores.

Check out jomashop they have a lot of Daniel Lee runway ~70-80% off North American prices and ~80-95% off Tisci era and they ship everywhere.

Deleting this post in 24 hours to gatekeep lol.

PDFSD

Well-Known Member

- Joined

- Mar 27, 2024

- Messages

- 2,304

- Reaction score

- 7,996

the thing is the so called cool people influencers know its not cool to wear it unless they are paid for it there is so much out there to choose form or align yourself with image and business wise .

same issue with Ferragamo not hype enough to buy it with own money like the girls do with Alaia or the row etc

same issue with Ferragamo not hype enough to buy it with own money like the girls do with Alaia or the row etc

Olaffo

Well-Known Member

- Joined

- Sep 23, 2020

- Messages

- 682

- Reaction score

- 2,581

I don’t think Burberry would survive another change of logo and direction if they’d fire Lee so, at least for now, he’s staying with renewed contract for probably next 3-5 years.

I hope they’ll finally find a good place on the market because I like the design and quality of products like trenches etc. It’s old and quintessentially British brand and it deserves to strive!

I hope they’ll finally find a good place on the market because I like the design and quality of products like trenches etc. It’s old and quintessentially British brand and it deserves to strive!

yslforever

Well-Known Member

- Joined

- Nov 13, 2021

- Messages

- 2,237

- Reaction score

- 7,639

That's scarcity game in the article is a joke, right ?

Having to send a bag - a Burberry bag, not a special order Hermès - from Europe to LA just because you have no inventory in North America tells more about you failing your operations than your desirability.

Can they really complain of not selling if they have nothing, or not the right thing, or not the right amount to sell ?

That's peak absurdity of fake scarcity.

Having to send a bag - a Burberry bag, not a special order Hermès - from Europe to LA just because you have no inventory in North America tells more about you failing your operations than your desirability.

Can they really complain of not selling if they have nothing, or not the right thing, or not the right amount to sell ?

That's peak absurdity of fake scarcity.

jeanclaude

Well-Known Member

- Joined

- Feb 12, 2012

- Messages

- 4,548

- Reaction score

- 13,070

But if he never does make that one hit, what would they do

Hit Daniel with a limited edition tartan-checked baseball bat??

Lola701

Well-Known Member

- Joined

- Oct 27, 2014

- Messages

- 13,576

- Reaction score

- 35,362

I don’t know. Even a HIT at that pricing won’t work.But if he never does make that one hit, what would they do

Daniel has had since his first collection fairly good reviews. I don’t think anybody is doubting his capacities as a designer of Burberry. Nobody is buying the Daniel Lee for Burberry at those prices.

Because even when I think about Bailey’s hits like the military collection in 2010. The Prorsum line had a trickle down on the BRIT line. Like the 2K/3K shearling parkas and motorcycle jackets had a BRIT version between 800/1500€.

The market is so crowded today that I think his Burberry may HIT on a long term but the pricing…

Maybe he should do a full military collection as a test.

I think unifying all the lines was a clever idea as customers never have the feeling of buying a « cheaper version of the original » but the pricing will still be at question.

And it seems like Lee’s stuff is moving in the outlets, more than Tisci. But if a customer has 2K today to spend on a trenchcoat, why would they choose Burberry instead of YSL or Celine or others?

Cocteau Stone

Well-Known Member

- Joined

- Feb 12, 2022

- Messages

- 1,979

- Reaction score

- 4,873

^ A military inspired collection could work to help boost a hit item or more sales traction. People don’t realise, but the resurgence of the boho/Glastonbury look has strong utterances of militarism and utilitarianism to contrast the heavy flou and relaxed louche look. Could be a chance to capitalise and test the waters.

I also think it would be a good opportunity for him to go into something more rigorous. A lot of his designs at Burberry involve a lot of fabric weight, so maybe something stricter could help. Who knows, it’s precarious waters at Burberry, and I don’t think Tisci’s tenure helped at all as a starting point for Lee.

I also think it would be a good opportunity for him to go into something more rigorous. A lot of his designs at Burberry involve a lot of fabric weight, so maybe something stricter could help. Who knows, it’s precarious waters at Burberry, and I don’t think Tisci’s tenure helped at all as a starting point for Lee.

Thefrenchy

Well-Known Member

- Joined

- Nov 13, 2006

- Messages

- 12,300

- Reaction score

- 2,893

Lola701

Well-Known Member

- Joined

- Oct 27, 2014

- Messages

- 13,576

- Reaction score

- 35,362

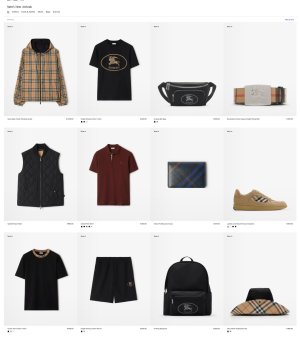

Im totally convinced that his team and the merchandising team are totally separated now. Much like the latest campaigns seems to follow his direction instead of being under his direction.Visiting their online shop is wild because it looks like Daniel Lee doesn't even work for the brandHundreds of products but barely anything from the runway it seems... Do they offer pieces from the runway collections only in stores now?!

That's currently their "New In" mens section...

View attachment 1381812

They have different tags for his stuff and they are also using Riccardo’s one on some new/old products.

I’m curious to see what they will do with the FW collection because it was quite rich and interesting. I’m sure that it will be a section in stores and also on the website, lost in a sea of ugly check merch.

He is keeping a job but really, if that’s the price to pay? What’s the point?

Thefrenchy

Well-Known Member

- Joined

- Nov 13, 2006

- Messages

- 12,300

- Reaction score

- 2,893

Im totally convinced that his team and the merchandising team are totally separated now. Much like the latest campaigns seems to follow his direction instead of being under his direction.

They have different tags for his stuff and they are also using Riccardo’s one on some new/old products.

I’m curious to see what they will do with the FW collection because it was quite rich and interesting. I’m sure that it will be a section in stores and also on the website, lost in a sea of ugly check merch.

He is keeping a job but really, if that’s the price to pay? What’s the point?

This is what I heard from industry people in London. Allegedly, he only gets to work on the shows and that's it. Barely touches anything image related too as it is being dealt directly by Marketing / CEO. And I mean... It shows...

Totally agree with you, what's the point of staying if that's to see your work erased.

I was re-reading his 2022 Vogue interview and this is how the article ended:

Will Lee stay as long? He seems to be approaching it a bit like he has his Georgian terrace. “I don’t try to predict too far into the future,” he says. “But you know, my intention is to write an iconic chapter.”

Well... I hope he gets to leave sooner than later, and is given the creative freedom he needs to be good.

Similar Threads

- Replies

- 1K

- Views

- 118K

- Replies

- 2

- Views

- 3K

- Replies

- 979

- Views

- 139K

- Replies

- 28

- Views

- 5K

- Replies

- 80

- Views

- 15K

Users who are viewing this thread

Total: 3 (members: 0, guests: 3)