You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Discussion: The State of Kering

- Thread starter LadyJunon

- Start date

LadyJunon

Well-Known Member

- Joined

- Aug 17, 2020

- Messages

- 5,043

- Reaction score

- 12,102

This is definitely giving PR puff piece.

I love how they refuse to acknowlege that the core elements of Gucci's identity is fantasy and opulence. Ford delivered that in a sleek jet-set sensuality. Gianinni took made Ford's aesthetic and made it softer and more romantic. Michele repackaged the Gucci identity in a more whimisical, gender-fluid maximalism. Sabato's doesn't have any fantasy or opulence in his Gucci, be it in the designs, the styling, the casting, the campaigns. It's like their trying to cannibalise on Saint Laurent and Bottega Veneta.Part of Gucci’s step back is to retrench around what made Gucci great in the first place: it’s Italian leather goods expertise. Ironically, it started to step away from that back in Gucci’s Tom Ford days when the shift from its luxury footing to being a fashion-first brand started.

“It moved from speaking about leather craftmanship – the pedigree Italians are known for– to being about fashion,” shared Philippe Mihailovich, founder of brand consultancy HauteLuxe and co-author of Haute ‘Luxury’ Branding.

“Everyone loved Tom Ford clothing and his design aesthetic. It became a big commercial success, but all of a sudden Gucci became the world of Tom Ford and Gucci became about his fashion,” he continued.

In the early days under previous creative director Alessandro Michelle, Mihailovich saw signs of a return to the brand’s Italian roots – “He brought a cultural reference to and reverence for the Italian Renaissance.” But then he seemed to get sidetracked by venturing too far into pop culture.

“Instead of the designer being the guide and interpreter for the world of the brand, the designer became almost bigger than the brand. It no longer looked like a serious luxury brand; it lost its essence,” he continued.

Enter Sabato De Sarno, who had been a luxury journeyman with Prada, Dolce & Gabbana and Valentino before stepping into the design director’s position at Gucci.

“I’m very excited about Sabato. He is into the details, knows about quality and understands a luxury brand is about timelessness. He has the ability to pull the brand back upwards again,” Mihailovich said.

HigthaVandah

Well-Known Member

- Joined

- Jun 16, 2024

- Messages

- 392

- Reaction score

- 1,057

Hedi has his fetishes. He's been sending them down his men's live/video runways for 25 years. To my eye he's not shy about his tastes at all.Hedi has never been able to do one sexe-up in his life though. Not everybody is aro-ace.

The Celine women, otoh, is "asexual", but I like that. The wearer can add sexiness with her personality when she wants to.

upNorth

Well-Known Member

- Joined

- Jul 28, 2020

- Messages

- 288

- Reaction score

- 513

Ooopsies. Again.

www.businessoffashion.com

www.businessoffashion.com

Kering Pounded by Luxury Slowdown, Warns on Profit

Sales at the French group fell 16 percent in the third quarter as a market-wide downturn hit hard. At flagship brand Gucci, where revenue fell 25 percent, management is exploring store closures while betting on a revamped handbag programme to jump start demand.

yslforever

Well-Known Member

- Joined

- Nov 13, 2021

- Messages

- 2,335

- Reaction score

- 8,150

So :Ooopsies. Again.

Kering Pounded by Luxury Slowdown, Warns on Profit

Sales at the French group fell 16 percent in the third quarter as a market-wide downturn hit hard. At flagship brand Gucci, where revenue fell 25 percent, management is exploring store closures while betting on a revamped handbag programme to jump start demand.www.businessoffashion.com

- (minus) 15/16 % for the whole group,

- 25 % for GUCCI (worse than expected),

- 12 % for YSL (worse than expected),

- 15 % other houses (Balenciaga, McQueen, Brioni, etc)

+ 5 % for Bottega Veneta

+ 7 % eyewear.

Good luck to them.

LadyJunon

Well-Known Member

- Joined

- Aug 17, 2020

- Messages

- 5,043

- Reaction score

- 12,102

Blazy must be punching the air right now.So :

- (minus) 15/16 % for the whole group,

- 25 % for GUCCI (worse than expected),

- 12 % for YSL (worse than expected),

- 15 % other houses (Balenciaga, McQueen, Brioni, etc)

+ 5 % for Bottega Veneta

+ 7 % eyewear.

Good luck to them.

GivenchyAddict

Well-Known Member

- Joined

- Feb 5, 2012

- Messages

- 2,546

- Reaction score

- 7,070

^ they will be on his back so fast to save as much as possible. This man is going pressed asf.

For SL, I expect more marketing stunts and no more hosiery- based collections for Vaccarello.

I can not wait for 2025. 😂

For SL, I expect more marketing stunts and no more hosiery- based collections for Vaccarello.

I can not wait for 2025. 😂

Living Proof

Well-Known Member

- Joined

- Feb 26, 2022

- Messages

- 114

- Reaction score

- 349

More like punching the wall, they’re probably gonna cut his campaign budget and make him design more candle tubs and perfume bottles.Blazy must be punching the air right now.

Frederic01

Well-Known Member

- Joined

- Jun 7, 2021

- Messages

- 1,944

- Reaction score

- 4,831

nationalsalt

Well-Known Member

- Joined

- Apr 23, 2024

- Messages

- 186

- Reaction score

- 329

I'm curious, why does Kering release sales reports for individual brands, unlike LVMH?

Lola701

Well-Known Member

- Joined

- Oct 27, 2014

- Messages

- 13,974

- Reaction score

- 37,561

Kering Deepens Austerity Measures as Profit Outlook Worsens

wwdLayoffs, store closures and contract renegotiations lookare on the menu after a tougher- than-expected third quarter.

By JOELLE DIDERICH OCTOBER 23, 2024, 11:50AM

PARIS — As France’s Parliament debates an austerity budget to tackle its gaping deficit, Kering is extending its own arsenal of cost-cutting measures to counter an expected 50 percent drop in operating profit this year.

Layoffs, store closures and contract renegotiations are all on the menu as the French luxury conglomerate seeks to right its ship after a tougher-than- expected third quarter that saw its star brand Gucci again miss expectations amid a sharp slowdown in China and Japan.

“Our absolute priority is to build the conditions for a return to sound, sustainable growth, while further tightening control over our costs and the selectivity of our investments,” François-Henri Pinault, chairman and chief executive officer of Kering, said in a statement after the market close on Wednesday.

The group, which also owns brands including Saint Laurent, Bottega Veneta and Boucheron, reported revenues fell 15 percent to 3.79 billion euros in the three months to Sept. 30, representing a decline of 16 percent in comparable terms.

The figures were below a Bloomberg-compiled consensus of analyst estimates, which had called for an 11 percent drop in comparable sales amid

the downturn in China and ongoing political turmoil worldwide.

Organic sales at Gucci declined 25 percent in the third quarter, versus analysts’ predictions for a 21 percent drop. In reported terms, revenues fell 26 percent to 1.64 billion euros.

Comparable sales at Saint Laurent were down 12 percent, while the “other houses” division — which groups brands including Balenciaga, Alexander McQueen and Boucheron — posted a 14 percent drop.

Bottega Veneta was a bright spot, with a 5 percent gain. The brand performed well in the U.S., Europe and the Middle East, powered by handbags, including the hugely popular Sardine style.

By comparison, organic sales at LVMH Moët Hennessy Louis Vuitton’s key fashion and leather goods division fell 5 percent year-over-year in the third quarter, also missing market expectations.

A New Team at Gucci

Gucci is in the middle of a turnaround process under creative director Sabato De Sarno, with Stefano Cantino poised to take over as CEO on Jan. 1, marking the second senior management change in two years.

Against that backdrop, Kering said it expects recurring operating income of around 2.5 billion euros in 2024 at group level, versus 4.75 billion euros last year.

It cited the larger-than-expected slowdown in the third quarter and “the major uncertainties likely to weigh on demand among luxury consumers in the coming months.” Gucci accounted for almost 64 percent of operating profit in the first half.

“At the risk of stating the obvious, the self-help Kering story seems yet to warrant investor commitment, no matter how apparently cheap,” Bernstein analyst Luca Solca wrote in a note after the results.

Chief financial officer Armelle Poulou said that despite a slight improvement in trends in September and October, Kering expects no substantial improvement in the fourth quarter, meaning gross margins will remain under pressure.

As a consequence, spending on advertising and promotion should be flat in 2024, accounting for a high-single-digit percentage of sales. With every dollar counting, some projects will be put on hold, while ad campaigns are designed to do double duty.

For instance, Gucci’s cruise 2025 campaign — shot by Nan Goldin and featuring stars like Debbie Harry — prominently features its new handbag launches in addition to serving as an institutional campaign situating the brand’s roots in London, Poulou said.

On that note, she appeared to confirm the departure of Gucci’s chief brand officer Alessio Vannetti, reported by BoF last week.

“We will be happy to welcome some new senior executives to lead the communication function, and that should be announced in due course, but we expect the new leadership structure in communication to be fully operational by the end of 2024,” she said.

Overall, De Sarno’s designs accounted for 35 percent of the brand’s revenues in the third quarter, up from 25 percent in the prior three-month period.

Hopes for Handbags

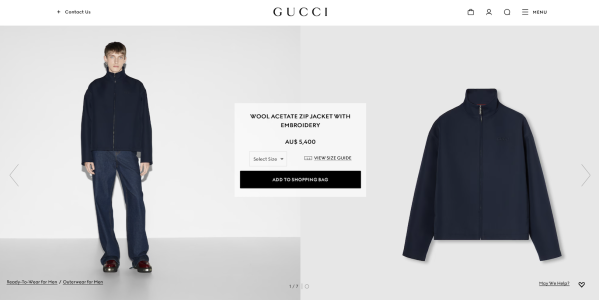

Management pinned high hopes on the introduction of four new Gucci handbag lines in September.

The most accessible is the GG Emblem, which retails for $2,490. The medium Blondie top-handle bag costs $4,200, while the oversize B bag is priced at $4,100. A soft version of the Horsebit bag is expected to play a bigger role during the holiday season, Poulou said.

“The new offer is resonating very well with existing customers,” she reported. “Where we have still some work to do and some challenges in the current macro environment is more about recruiting new customers, and that is also linked to the fact that the traffic is very much down in many regions, especially in Asia-Pacific.”

Retail revenue fell 30 percent in Asia-Pacific in the third quarter, 15 percent in North America and 11 percent in Western Europe, Kering said.

Sales in Japan eked out a 3 percent increase, following a 27 percent jump in the prior quarter, while the rest of the world progressed 2 percent.

The fortunes of luxury stocks have been closely tied to China’s economic stimulus measures designed to counter weakness in domestic demand amid a slumping property market and high youth unemployment.

The world’s second-largest economy will grow by 4.8 percent this year, down from the previous projection of 5 percent in July, the International Monetary Fund said in its latest “World Economic Outlook” report.

Kering revenues from Chinese nationals were down 35 percent at group level in the third quarter, and it’s too early to know when the government stimulus measures will bear fruit, Poulou said.

On the heels of a disappointing Golden Week holiday, Kering is now looking to downsize its directly operated store network, especially in Greater China.

“The idea is to close the smaller stores or the ones that are not in the best location, and probably extend the size of some of the best stores in order to get the right footprint,” Poulou said.

It will also continue to close outlets, especially in Asia-Pacific, and reduce its wholesale network as it battles the gray market, the executive said.

Meanwhile, a deal to bring in investors as majority owners of some of its stores in New York City and Paris should be signed by year-end and is expected to yield 1.4 billion euros in cash, she added.

In the meantime, the cost-cutting continues apace.

“We have raised the efficiency and productivity in retail with some headcount reductions, especially at Gucci,” Poulou said.

“We are renegotiating some supplier contracts, for example, we made changes to transport and logistic arrangements that delivered substantial savings, and we chase inefficiency and duplication leveraging on our previous investments,” she added.

“And of course, we are very strict in terms of corporate spending. All those efforts are efforts that are not one-off and that will be sustainable going forward,” she said.

She noted that French Prime Minister Michel Barnier’s plan to raise the corporation tax should have limited impact on Kering’s effective tax rate at group level, since most of its operations are based in Italy. LVMH, on the other hand, estimated the cost of the measure at 700 million euros to 800 million euros.

With luxury in a cyclical slump that analysts predict could last for one or two years, companies in turnaround mode are feeling the pressure more than others.

Kering’s share price has fallen by 46 percent from its intra-year peak of 434.50 euros on Feb. 22. Reflecting pessimism about the company’s prospects, Citi recently downgraded the stock to neutral.

“The magnitude of Kering’s [third-quarter] sales miss and [quarter-on- quarter] slowdown mirrors that of LVMH’s fashion and leather division, hence not a major surprise in our view, although it will likely be the luxury sector’s worst revenue performance this quarter,” analyst Thomas Chauvet said in a research note on Wednesday.

“The impact of our cost optimization initiatives, like our efforts to rebuild healthy, sustainable top-line growth, will not materialize overnight, but we are all pushing in the right direction, and we are all committed to a successful outcome,” Poulou countered.

“We want to make 100 percent sure that top-line growth, when it returns, is based on absolutely sound premises,” she said.

yslforever

Well-Known Member

- Joined

- Nov 13, 2021

- Messages

- 2,335

- Reaction score

- 8,150

Because they are much smaller and not so many divisions, Kering is luxury fashion & leather goods only, while half of LVMH is jewelry (Bulgari, Tiffany's), distribution, alcohol, watches too.I'm curious, why does Kering release sales reports for individual brands, unlike LVMH?

TerraVera

Well-Known Member

- Joined

- Dec 23, 2023

- Messages

- 205

- Reaction score

- 334

So :

- (minus) 15/16 % for the whole group,

- 25 % for GUCCI (worse than expected),

- 12 % for YSL (worse than expected),

- 15 % other houses (Balenciaga, McQueen, Brioni, etc)

+ 5 % for Bottega Veneta

+ 7 % eyewear.

Good luck to them.

goodness. yikes! somebody's gonna lose their job...

with these numbers we are entering desperate days and thirsty for viral moments phase in kering's senescence. more than ever they need an it bag or it shoe to cauterize the bleeding a little. what's sad is it doesn't have to be like this if they treated designers better. we might even start seeing designers getting shorter contracts - instead of 5 years, they may have 2 to prove themselves.

i can't believe i'm saying this... if heidi shows up at gucci i would not be surprised. but what's a larger issue is there aren't a lot of designers who have the ability to revive a brand; creating a renaissance moment is what put a lot of designers on the map: their strong vision, creative adaptability to the codes, their keen grasp on the pulse of culture, and merchandising skills is what maintains longevity. such a talent is rare.

maybe they are better off selling

Frederic01

Well-Known Member

- Joined

- Jun 7, 2021

- Messages

- 1,944

- Reaction score

- 4,831

Kering Deepens Austerity Measures as Profit Outlook Worsens

wwd

The faith they have in Sabato de Sarno and the turnaround of Gucci is getting quite ridiculous at this point. I don't know what more proof they need that it's just not going to work?

His contract is either airtight or they are waiting for a free agent because no other explanation makes sense.

yslforever

Well-Known Member

- Joined

- Nov 13, 2021

- Messages

- 2,335

- Reaction score

- 8,150

I think they are waiting to find his replacement.The faith they have in Sabato de Sarno and the turnaround of Gucci is getting quite ridiculous at this point. I don't know what more proof they need that it's just not going to work?

His contract is either airtight or they are waiting for a free agent because no other explanation makes sense.

But TBH I see only one person capable of turning a mega-brand around rn and it's Hedi.

But he hates monogram and I don't see him working for Kering again.

Lola701

Well-Known Member

- Joined

- Oct 27, 2014

- Messages

- 13,974

- Reaction score

- 37,561

Hedi again?I think they are waiting to find his replacement.

But TBH I see only one person capable of turning a mega-brand around rn and it's Hedi.

But he hates monogram and I don't see him working for Kering again.

How many clones fashion houses are you (all) willing to see this man create?

He did monogram at Saint Laurent and Celine so he knew how to deal with it.

If he didn’t have an HR issue with Kering, Daniel Lee would have been good for the house. I can see the head of MM6 take over too. I think at Gucci they needs someone who can do menswear and womenswear with a strong vision. The whole thing around the house cannot serve the ego of the designer but preserve the brand.

Hedi’s work is too much about him and not so much about the house, even when he sleeps in the archives.

yslforever

Well-Known Member

- Joined

- Nov 13, 2021

- Messages

- 2,335

- Reaction score

- 8,150

Realistically, who has proven themselves capable of a 180° revamp in the last 15 years ?Hedi again?

How many clones fashion houses are you (all) willing to see this man create?

He did monogram at Saint Laurent and Celine so he knew how to deal with it.

If he didn’t have an HR issue with Kering, Daniel Lee would have been good for the house. I can see the head of MM6 take over too. I think at Gucci they needs someone who can do menswear and womenswear with a strong vision. The whole thing around the house cannot serve the ego of the designer but preserve the brand.

Hedi’s work is too much about him and not so much about the house, even when he sleeps in the archives.

Lola701

Well-Known Member

- Joined

- Oct 27, 2014

- Messages

- 13,974

- Reaction score

- 37,561

For me it’s not enough. It’s not because he managed to make it work for many brands that he should just take over everything.Realistically, who has proven themselves capable of a 180° revamp in the last 15 years ?

And it’s even worse because we are getting brands that are losing their identity and products that looks a like.

For me, the Hedi formula has run stale.

I can barely tolerate him at Chanel because he has done Chanel almost all his career but come on.

Gucci needs to stand out, not to blend in.

Saint Laurent has yet made the total progression towards the exit of Hedi’s dominance because Vaccarello is mediocre in menswear. Celine will take time to really be it own so we don’t need him at Gucci sorry. At least at Chanel there are gatekeepers and his fashion can be integrated into the whole narrative of the house.

GivenchyAddict

Well-Known Member

- Joined

- Feb 5, 2012

- Messages

- 2,546

- Reaction score

- 7,070

Fabio Z is right there… but I guess he knows his worth to say no to Gucci. 😅

HigthaVandah

Well-Known Member

- Joined

- Jun 16, 2024

- Messages

- 392

- Reaction score

- 1,057

As many as he wants to. I'm curious to see Hedi through the Armani lens, the Chanel lens, the Gucci lens... anywhere, really. For me the problem is that there aren't more designers with equally strong visions who can take a house in a new direction after Hedi. At least not ones that investors are willing to take a chance on.Hedi again?

How many clones fashion houses are you (all) willing to see this man create?

Similar Threads

- Replies

- 286

- Views

- 43K

- Replies

- 1K

- Views

- 174K

- Replies

- 7

- Views

- 2K

- Replies

- 2K

- Views

- 167K

Users who are viewing this thread

Total: 1 (members: 0, guests: 1)

New Posts

-

-

Jonathan Anderson - Designer, Creative Director of JW Anderson & Christian Dior (18 Viewers)

- Latest: style_expert

-

-

-