Can this fashion house take advantage of its 'Britishness' to rise to the top?

Just about every chief executive who has run Burberry Group Plc has characterised the maker of the pricey trench coats with checked linings as the best of British luxury.

But that tag is doing little at the moment to lure potential buyers of high-end fashion. Or even investors, for that matter.

Years of efforts to place the UK fashion house’s products on the same racks as those of top-tier labels like Louis Vuitton, Hermes and other European fashion houses have fallen short, with the latest evidence of that coming this week when Burberry reported a plunge in sales – capping a disappointing end to a fiscal year hit by weak demand in China and the US.

While a flight to quality is sheltering some haute couture brands, Burberry – like Gucci-owner Kering SA – is getting hammered as Chinese buyers turn cautious.

The company’s stock has more than halved in the past year, wiping at least £5.5bil (approximately RM32.8bil) off its market capitalisation. And all indications are that the worst is not over – the brand has said wholesale revenue is set to fall further this year.

About 74% of the analysts who follow the stock rate it "neutral”, reflecting deep skepticism over its ability to rebound anytime soon.

Burberry, which held an analyst call this week, said it had no further comment.

"The Burberry brand doesn’t have, at the moment, the ability to resonate,” said Luca Solca, a senior analyst at Bernstein Autonomous LLP.

"It either needs to change or it needs to work.”

The challenge for chief executive officer Jonathan Akeroyd and creative designer Daniel Lee is to show that the partly completed transition they inherited in 2022 to elevate the brand is still on track and will eventually bolster sales and profits.

Akeroyd has blamed the company’s current woes on the rough economic context, especially in China, which accounts for more than a quarter of sales.

"(It’s) a clear challenge we have in terms of traffic, traffic into the malls and definitely a bit of a softening in general, which is clearly impacted by the China economy,” Akeroyd told analysts.

Trouble is, other labels at similar price points with high exposure to China – such as Prada SpA – are weathering the storm.

The Italian fashion house’s net revenue beat expectations to rise 17% last year, while retail sales for its subsidiary Miu Miu jumped 82% in the fourth quarter.

"At what point do we say, this is Burberry specific,” asked Sophie Lund-Yates, an equity analyst at Hargreaves Lansdown.

If now’s the time to ask that, what is Burberry getting wrong?

Famed for its distinctive checks, the brand began in the 1800s, designing functional rain wear – to be worn in the Arctic and in the trenches, rather than on runways.

From there, it became a wardrobe staple of the British upper class. And by the mid-1990s, its popularity grew so much that one in five coats exported from the UK was a Burberry product, according to the company.

With the emergence of a burgeoning middle class, especially in countries like China, Burberry joined a lot of luxury brands that started what academics like to call a "democratisation” process, targetting larger sales volumes even at the risk of cheapening the brand.

Burberry went so far in this effort that its "distinctiveness signal started getting diluted”, said Paurav Shukla, a professor of marketing at the Southampton Business School.

"For almost two decades it has gone into this direction of democratisation and now it wants to become exclusive, and that’s not going to happen overnight,” he said.

A changing cast of chief executives and key designers – each with their own vision – hasn’t helped.

Christopher Bailey, whose appointment as joint CEO and creative designer in 2014 spooked investors because he was a fashion star with no business credentials, left the role within four years.

He was replaced by former Celine boss Marco Gobbetti, who left after about five years.

Gobbetti’s appointment was initially seen as a win for Burberry since the Italian was well regarded for his roles at Celine, Givenchy, Moschino and Bottega Veneta. His plan to elevate Burberry to the ranks of super luxury was also welcomed by investors, and he hired fellow countryman Riccardo Tisci as designer.

Gobbetti’s moves to stop selling to wholesalers and retailers in the non-luxury sector, particularly mass market US outlets, and step up production of luxury leather handbags was seen as the right decision for the brand.

But Tisci failed to really ignite demand, with critics arguing that while the streetwear aesthetic he brought to the brand attracted younger shoppers, he didn’t make the most of its British heritage and reputation for classic tailoring.

Gobbetti left halfway through his revamp plan to run Salvatore Ferragamo.

Burberry’s inability to leverage its heritage prompted Nick Train, one of its largest shareholders, to say in 2023 that the company was one of his biggest disappointments.

"Burberry is not and never will be an LVMH or a Hermes, but it does have a genuine global luxury brand, particularly its iconic outerwear franchise,” he said at the time.

Now, with British duo Akeroyd and Lee at the top, Burberry is once again trying to take advantage of its "Britishness”.

Akeroyd, whose career has spanned Harrods, Alexander McQueen and Versace, has set a target of hitting more than £5bil (RM29.8bil) of sales for a brand that has hovered between £2.5bil (RM14.9bil) and £3bil (RM17.9bil) mark for the last decade.

Lee, who’s 19 months into his creative director role, has revived Burberry’s logo of an equestrian knight while featuring talent like British model Naomi Campbell and musician Skepta.

So far, it hasn’t been enough to revive the brand’s fortunes.

"It is always a struggle to elevate a brand and it requires unique cultural relevance and consistency over time,” said Nader Tavassoli, a professor of marketing at the London Business School.

"Luxury is about desirability and it will take time to establish a consistent note.”

As Burberry fights to climb up the scale of "desirability”, the holy grail sought by all luxury brands, its ranking on the Lyst index that tracks labels and products according to searches and references on social media has averaged at 12th since 2018 – far behind European names like Gucci, Prada and Versace.

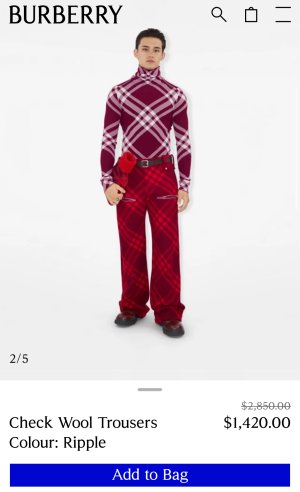

A part of the lack of traction has been pricing. In its quest for affluent shoppers, Burberry’s latest collections carry hefty price tags, which is driving some buyers away.

A 45-year-old Spanish shopper visiting the company’s Regent Street store in London on Friday said that while he came specifically for a trench coat, he didn’t immediately buy one because the price was higher than he’d hoped.

Lee’s debut Autumn 2023 collection saw bags priced at about £2,500 (RM14,900) and a wool duck beanie costing almost £3,000 (RM17,900).

While customers might be willing to shell out such amounts for items from Hermes or LVMH, they still don’t place Burberry in that league.

The brand remains exposed to what the industry calls an aspirational shopper, one who’s new to luxury. Such buyers tend to be more economically sensitive than people with ultra high net worths.

Aspirational shoppers also trounced the fortunes of Kering, which said last month that it expects a hit to profit due to weak sales at Gucci.

Meanwhile, Akeroyd has said he wants to double sales of leather goods and womenswear while driving demand for higher-margin accessories, such as handbags, belts and scarves.

He’s banking on Lee to replicate his successes at Bottega Veneta, where the designer launched the "it” Pouch and Cassette bags, and where his Lido square-toed mules became a hit.

Akeroyd also wants to diversify a business that’s too reliant on some categories and geographies.

Burberry’s sales from Chinese shoppers, which pre-pandemic accounted for about 40% of sales, are still struggling – falling by 19% in the last quarter.

Akeroyd’s revamp also hasn’t been helped by a downturn in demand in the US or changes to tax-free shopping in the UK that has pushed tourists to spend their money in Paris, Milan and elsewhere in Europe.

So is Burberry the stock to bet on if the macroeconomic backdrop starts to ameliorate? Not everyone is convinced it is.

"There are more compelling names in the sector,” said Lund-Yates. "Are we looking at Burberry as a massive turnaround story? I think that horse may have bolted.”